Blog | Personal Finance

How to Budget Money Tips for 2024

When it comes to budgeting, there are two different mindsets. One makes you rich and the other makes you poor. Which mindset do you have?

Rich Dad Personal Finance Team

January 02, 2024

Summary

-

Budgeting done right is the key to becoming rich

-

Understanding the difference between an asset and a liability is essential for proper budgeting

-

Saving won’t make you rich - spending will

When it comes to financial freedom, saving is a losing strategy. It’s important to remember that cash is just simply a currency; in order for it to bring value, it must move into something. If it stops moving, it dies. Just like an electrical current.

Many people think that putting money in a savings account that accrues interest is a form of investing. Unfortunately, the interest received can be offset or even eradicated by inflation. For that reason, saving money means you’re not growing your money at all. In fact, there's a strong chance your money will lose value as inflation outpaces your gains.

That’s why in order to be rich, you have to budget like the rich.

In this post, we’ll dive into what that looks like — all consolidated into four critical Rich Dad Poor Dad tips.

How most people budget

For most people who are in the middle-class, a budget is a way of taking a known income amount-your salary-and planning your expenses based on that income. It's a fairly straightforward process (if you're organized!). You simply take your expected expenses based on past trends and match them up to your known income.

If there's a shortage, you cut expenses. If there's a surplus, you decide what to do with the extra money. As an aside, too often the extra money is spent on something like a vacation or a new car, meaning money that could be working for you is now making you work for a liability.

How rich people budget

Again, saving is losing.

There is no shortage of stories about currencies crashing to nothing. But the truth is, you don’t have to go that far back in history to find examples of when saving cash was a losing strategy.

For example, in 1983, the Zimbabwean dollar could be exchanged 1 to 1 with the US dollar. By 2008, it took 669 billion Zimbabwean dollars to exchange for that same US dollar. Because it was decimated by hyperinflation in the early 2000s, people who saved Zimbabwean dollars lost — big time.

In short: cash is a sum zero game.

So if saving is losing, how does one win? Start by looking at how you budget.

Poor dad said, “Live below your means.”

Rich dad said, “Expand your means.”

Poor dad’s budget focused on cutting expenses to meet his income. It was his priority to pay everyone else first, and then enjoy what was left — if any.

Rich dad’s budget focused on increasing income. It was important that he paid himself first, and then took care of expenses. “Most people use their budget as a plan to become poor or middle class rather than become rich;” he said, “My budget is a plan to become rich.”

So without further delay, let’s explore the four budgeting tips of the rich.

Tip #1: A budget surplus is an expense

One of rich dad's most important lessons was, "You have to make a surplus an expense."

He was referring to the idea that most people view a surplus as an asset; and perpetuate that concept by placing their extra cash in the bank or spending it on liabilities. Instead of viewing extra money as an asset, rich dad viewed it as an expense in the form of charity, investing, and saving.

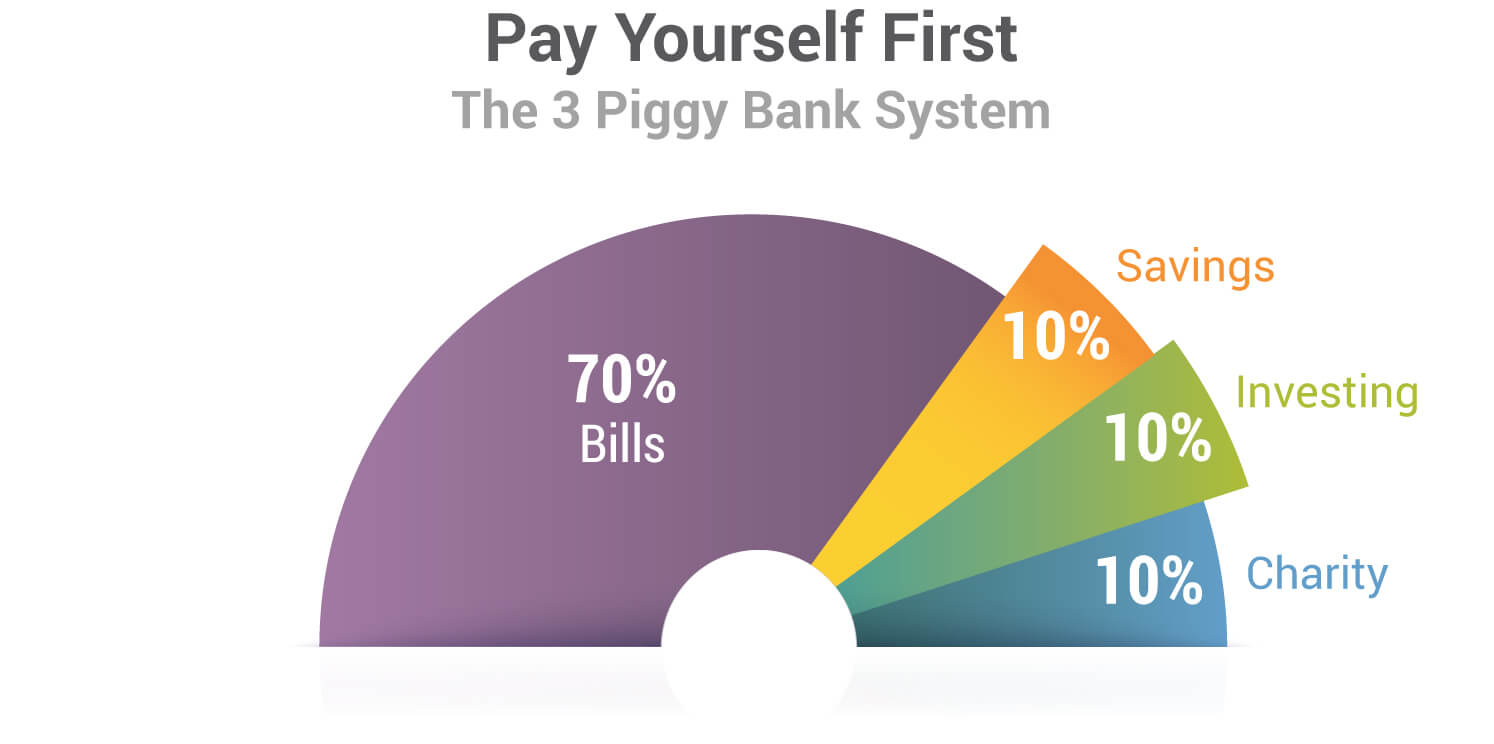

Most people want to give to charity, invest in assets, and save money, but the problem is that they view it as something to do after they've paid their expenses. Rich dad, however, made these things expenses in his budget and made them a priority. This is called “paying yourself first” where a portion of money is set aside for savings in the event of an emergency.

This is key to understanding how to save money and get rich. Rich people budget savings not as an investment or means to get rich, but as a hedge to protect them should the need arise and they can’t liquidate their assets quick enough. As a bonus tip, consider saving about six months of living expenses at any given time.

Tip #2: Your expense column determines your financial future

Once you enter the real world, you soon discover that bankers don’t care about your grades. Rather, they are only interested in your financial report card.

What is a financial report card? The answer can be found with your personal financial statement.

The income section of an income statement is where you place every source of income you make: earned (paychecks, tips, wages), portfolio (dividends from stocks), and passive (cash flow from real estate). Your expense column, however, is where you list everything you pay for each month like your mortgage, car, and insurance payments.

To predict your financial future, look no further than your expense column.

Here is a comparison of two different expense columns:

|

Person A

|

Person B

|

|

Donation to charity

|

Six-pack of beer

|

|

Savings

|

New shoes

|

|

Books on investing

|

New TV

|

|

Seminar on real Estate

|

Football tickets

|

|

Gym shoes

|

(Another) six pack of beer

|

|

Personal coach

|

Bag of potato chips

|

While that’s a humorous example, it’s not far from the truth. When you look at most people’s expense columns, they’re littered with payments to other people and for liabilities. In each case, expenses don’t go towards anything that will make money and only things that permanently take money out of your pocket.

As you evaluate your budget for this year, take a look at your expense column. What does it say about you? If it looks more like the right column than the left column above, then you’ll find it difficult to get rich.

Tip #3: Use assets to pay for liabilities

As we discussed above, most budgeting tools help you gain a better understanding of your finances by instructing you to list your monthly income and expenses using a budgeting template or spreadsheet. While this is a great start, the income statement only shows you half of your financial picture. To understand your entire financial picture, you need to also understand your assets compared to your liabilities.

What’s an asset vs a liability?

Simply put, an asset is anything that puts money in your pocket, regardless of whether you work for it or not. Dividends from a stock, rental income from a real estate investment, or residuals earned from book sales are all different forms of assets.

A liability, on the other hand, is anything that takes money out of your pocket. While many people consider their home to be an asset, it’s actually a liability. Not only do you have the mortgage to eventually pay off, but the property taxes, utilities, and maintenance will always take money out of your pocket.

The key is to acquire assets that pay for your liabilities.

Instead of saying “we can’t afford it,” ask yourself “ how can we afford it?”

By increasing assets, which in investments like real estate, increase monthly cash flow, this is how you can purchase luxury items and liabilities. If you want a nice car, invest money until the asset produces the cash flow required to purchase that car. Then, you’ll have a nice car anda great asset. Thisis why paying yourself first in your budget is the most important thing you can do to get rich.

Tip #4: Don’t save; spend to get rich.

Being able to execute on the first three tips on budgeting means building a mindset that says when the going gets tough, the tough get going. Most people stop spending on charity, investing, and saving when times get tough. That is not how rich people budget. The rich figure out ways to make more money by spending more money on assets, even when times are tough.

By pushing through those hard times, you develop a mentality that will enable you to make more money no matter what the circumstances. That will make you richer than you ever imagined.

When Robert and Kim began their businesses over three decades ago, they had their eyes set on one thing: financial freedom. It took less than a decade for them to accomplish their goal. Once they had passive income flowing into their pockets each month that covered their expenses, they knew they were free.

It wasn’t easy, however. When they started out, they were over $1 million in debt, refusing to throw in the towel, they couldn’t bring themselves to get jobs, and settle into a middle-class life. They knew that the only way to achieve financial freedom was through acquiring assets. That required them to pay themselves first with their three-piggy bank system mentioned above and hired a bookkeeper, Betty, to keep them accountable.

Although Betty didn’t agree with their plan, she agreed to follow it and was a vital part of keeping Robert and Kim on track. What they asked her to do was place money in three separate accounts: emergency savings, investing, and charity. Their creditors, and there were many, were to be paid with what remained. There were many months when Betty informed them that we weren’t going to have enough money to fund their three piggy banks and the creditors. This was the motivation they needed to find extra money.

The temporary pain was necessary for them to increase their financial education, spend money on acquiring assets, and achieve their goal of financial freedom. By pushing through those hard times, they developed a mentality that enabled them to make more money, no matter the circumstances.

And that will make you richer than you ever imagined.

Original publish date:

June 26, 2012