Blog | Personal Finance

How to Get Out of the Holiday Rat Race

December 15, 2020

Welcome to the holidays in the time of COVID. You’d think given the way things are across the country with the pandemic that this would be a calmer holiday season. Maybe folks would take advantage of the opportunity to slow down and reflect on what really matters. But we’re just not wired that way, and there’s no doubt about it, this holiday season is full of the same hustle and bustle as any other one.

But by now, you’ve probably enjoyed a large meal for Thanksgiving (social distanced, of course), watched a lot of football (with fake crowd noise, no less), and picked up some “great” deals online on Black Friday, Small Business Saturday, and Cyber Monday—three days that make up the biggest shopping days of the year (though the seemed to start in early November this year).

Over the course of the weekend, Black Friday shoppers were expected to spend on average $967.13, up 3.4% from $935.58 they spent last year. This is astounding given the fact that half of all American families have next to nothing saved for retirement. As Business Insider reports, “The average retirement savings of all American families is $95,776, but there is more to that number than meets the eye. Since so many families have no savings, the median—50th percentile—family has just $5,000 saved.”

Spending holiday money today at the expense of your future is the definition of the Rat Race

What can be the explanation for people seemingly losing their collective minds when it comes to holiday spending? The answer lies in the fact that our culture is engineered to produce great employees and great consumers. The retail industry are masters at advertising and marketing, getting you to desire what you don’t need and to compare yourself to others around you, or an ideal life you haven’t realized yet. In short, our culture specializes in Keeping Up with the Joneses.

At Rich Dad, we call this the Rat Race, and the holidays are the time of year when the pressures of the Rat Race are felt the most.

The majority of people live their lives in the Rat Race. They buy into the old rules of money: go to a good school, get a high-paying job, buy a house, and invest for retirement in a diversified portfolio of stocks, bonds, and mutual funds. I’ve written extensively on why these rules don’t work any more, such as my article last year, “The Real Reason You Feel (and Are) Poorer”.

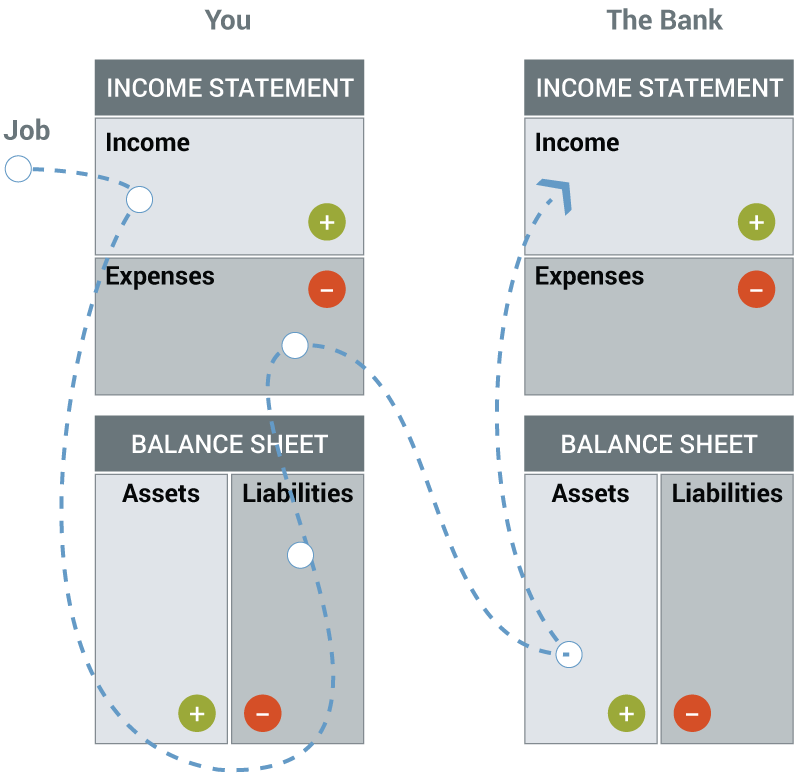

In the Rat Race, you don’t actually generate wealth. Instead, you trade your time for money, and you spend it on liabilities that take that money out of your pocket. The financial statement of a person in the Rat Race might look like this:

Your Rat Race expenses are always making someone else rich

In the image above, there are two financial statements listed for a reason.

Rich dad said, “Sophisticated investors must see at least two financial statements simultaneously if they want a true picture.”

He also said, “Always remember that your expense is someone else’s income. People who are out of control of their cash flow make the people who are in control of their cash flow rich.”

In the Rat Race, you make other people rich through your spending habits. Your income goes to liabilities, which are assets for someone else. In the case of the chart above, it’s your mortgage making the bank rich because it is their asset and your liability. But this chart could have easily been your Black Friday weekend shopping making the retailers rich.

How to get out of the Rat Race

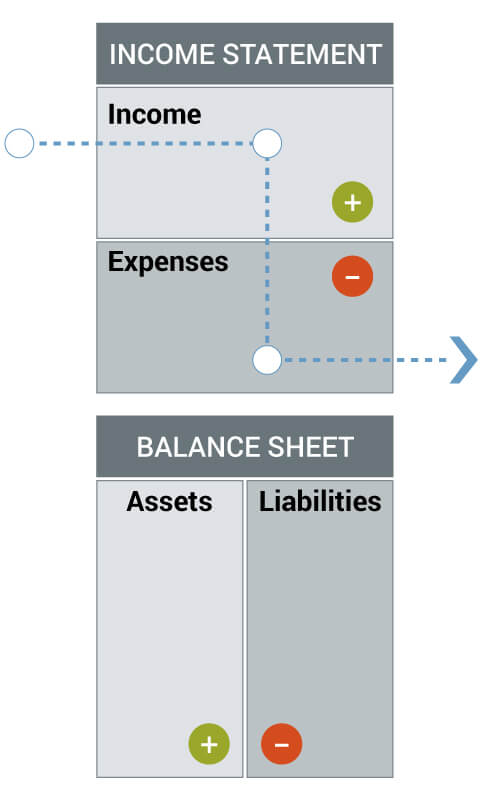

The rich don’t live in the Rat Race because they understand the fundamental concept of the differences between assets and liabilities. The financial statement of a rich person looks like this:

Rather than primarily spend their income on liabilities, the rich spend it on assets that produce cash flow, which they then use on either more assets or if they can afford it, liabilities.

This is fundamentally how they get out of the Rat Race. Rather than use their income to make someone else rich, they use it to make themselves rich.

Now, does that mean they don’t buy liabilities or contribute to others’ asset columns? No. But it does mean that they do so out of the abundance of the wealth created by their own assets (passive income), not with money that comes from employment (earned income). The cash flow patterns between the rich and the middle class and poor are like night and day.

How about a different focus this holiday season?

At this point, you’ve probably done your shopping. Maybe you’ve spent hundreds of dollars on toys and gadgets—some of you have spent thousands. I sincerely hope you haven’t spent too much on items that will probably be forgotten a year from now while it may have put yourself in a bad financial position.

I remember my first holidays with my wife, Kim. We were poor and didn’t have much, but we found a way to make it work. I always liked to buy Kim nice things, but I refused to spend money if I didn’t have an idea where it was coming from. We worked hard to pay ourselves first by setting aside money for investing and for increasing our financial education before we spent it on gifts for each other. That was more important than nice gifts. We knew financial discipline then would create financial freedom later.

As I became more financially free, the gifts became nicer and easier to buy. Today, I can spoil my wife with lavish gifts because I know that my investments allow it—and thankfully, she can spoil me too. It’s a nice place to be in, but it wasn’t an overnight process, it took years of financial discipline. At the end of the day, what I enjoy most is giving good things to my wife because I know it makes her happy. For me, the richest gift is seeing my wife filled with joy. As the old saying goes, it’s always better to give than to receive.

As the Holidays fast approach, we would do well to remember what our richest gifts are—our families and our friends. For years, I’ve dedicated my life to building The Rich Dad Company to provide the highest level of financial education available. Our mission is to equip you with the knowledge needed to be financially free. After all, knowledge is the new money.

However, it would be misguided to say that Rich Dad is just about money. Money is important, no doubt about it. And a big part of our message is getting smarter with your money. But at the end of the day, Rich Dad is about freedom and security—things that money brings. Our belief is that financial education creates a world that is freer and more secure. It is a world where you can enjoy your family because you have more time and you can rest easier at night because you know you’ve invested well and set your family up for financial security

This holiday season, as the presents are opened and the tables are set, take the time to really enjoy the loved ones in your life—your richest gifts. And take a moment to assess whether you’ve set them, and yourself, up for financial freedom—to get out of the Rat Race. The best gift you can give your family is a sound financial education and a bright financial future. Those gifts will last a lifetime.

Happy Holidays from all of us at Rich Dad.

Original publish date:

November 28, 2017