Blog | Personal Finance

Millennial Money: Saving vs Investing

August 28, 2020

Millennial women, it’s time to start thinking differently about saving your money

Ever since I knew what a dollar was, I was taught to save money. I remember walking into our local bank with my mom to open up my first savings account. In those days, it was all done manually. I received my passbook with my initial deposit, a hefty $10. It was official. I had now entered the world of money. I felt very grown up.

I’m not alone in this. Most women are told to save money, but for the most part, we’re not very good at it. In fact, nearly one in five working women have nothing saved for retirement — despite the fact that studies show millennials are saving a bit more than Gen X and baby boomers did.

Saving vs Investing for Millennial Women

The old advice to save money has echoed from generation to generation throughout history —and it is still being echoed today. Seeing an uptick in savings is nice, but this saving is not matched by an increase in financial education (of course, if it were, there’d be less saving!). As I wrote before, “43% of women report than no one has taught them about investing at all.”

Unfortunately, the little benefit saving money could have for women is erased by the fact that they severely lack true financial education.

Our young women (and our older ones too) would be better served responding to the lessons of the Great Recession by doing less saving and more investing — both in their financial intelligence and with their money. According to a report by Merrill Lynch, women are equally confident to men in most financial tasks — except for investing. Only half of women say they feel confident in managing their investments.

Here’s a few reasons why I’m so down on the idea of saving money.

The (lack of) interest you earn on savings. Interest rates on savings throughout much of the world are extremely low, almost nonexistent in some parts. Your savings account is actually a loan to your bank. The bank takes the money from your savings account and loans it out to its customers at a much higher interest rate than they pay you. You basically finance your bank’s business for a ridiculously low rate of return on your money.

If you were going to invest your money into a new electric-car start-up company, would you accept a return of 1 percent or less for your investment? Probably not. Yet, that’s what happens when you put your money into your bank’s savings account.

Inflation. Governments who fear that their countries will fall into a depression are printing money to artificially prop up the economy and give the illusion that the economy is stronger than it really is. The problem with this funny money flooding the world, however, is that it will lead to inflation — possibly even high inflation. What does inflation mean in everyday terms? It means that your dollar buys less — your favorite brand of shoes or jeans will cost you many more dollars, euros, yen, or pesos in the future than they do today.

Why would printing money lead to inflation? Here is a simplified explanation: Let’s imagine that there is only $100 in the world. And in this world, there are only five products available. That would mean that, on average, each product would cost $20.

The world government decides to print more money, thus putting more money into the world economy. It prints an additional $900. However, that money does not go to create more products or to grow the economy. It is used to pay off debt and prop up failing banks and businesses. So nothing new is created.

Now, instead of $100 circulating in the economy, there is $1,000. Yet, there are still only five products available. Those five products are no longer valued at $20 each, but are now valued at $200 each. That is how inflation works, and that is the result of the government printing more and more money.

Worth-less money. If inflation, especially high inflation, does occur, then it costs you much more to buy the same items you purchase today. Instead of $3 for a loaf of bread, you may be shelling out $12, for example. That dollar, euro, yen, or peso that you saved would then be worth only one-quarter of what it was previously worth.

Another example is what happened in Zimbabwe back in the early 2000s. In 1983, one US dollar was equivalent to one Zimbabwean dollar. Two decades later and it took 669 billion Zimbabwean dollars to equal that same one US dollar.

The problem with saving money is, of course, that as it sits in savings, gaining very little to no interest, it doesn’t grow at the pace of inflation. Your money becomes worth less and less.

By investing, however, you can put your money in assets that hedge against inflation by growing in worth as inflation grows.

Millennial money and saving

Saving money, for me, is a short-term proposition. I save money while looking for my next investment. When an investment appears, I invest the money I’ve been saving in something that would give me a solid return on my money.

How difficult do you think it would be to find an investment that delivered a rate of return better than the 1 percent that your bank’s savings account is earning you? It’s not difficult. All it takes is a bit of financial education and a willingness to take a risk — even a small one.

Today, if you’re a millennial woman whose primary retirement strategy has been to tuck your money away into a savings account, I encourage you to start thinking differently.

Millennial Money Investing Advice #1: Why saving more returns less

One of rich dad’s most important lessons was, “You need to turn a surplus into an expense.”

What does that mean?

Most people consider a surplus of cash as an asset. After they pay for their monthly expenses, they put the remaining money in the bank to later spend it on liabilities.

However, here at Rich Dad we don’t consider that extra cash as an asset. We define an asset as anything that puts money in your pocket regardless of whether you're working or not. Rather than consider the extra cash as an asset, we view it as an expense in the form of charity, investing in cash flowing assets, and savings.

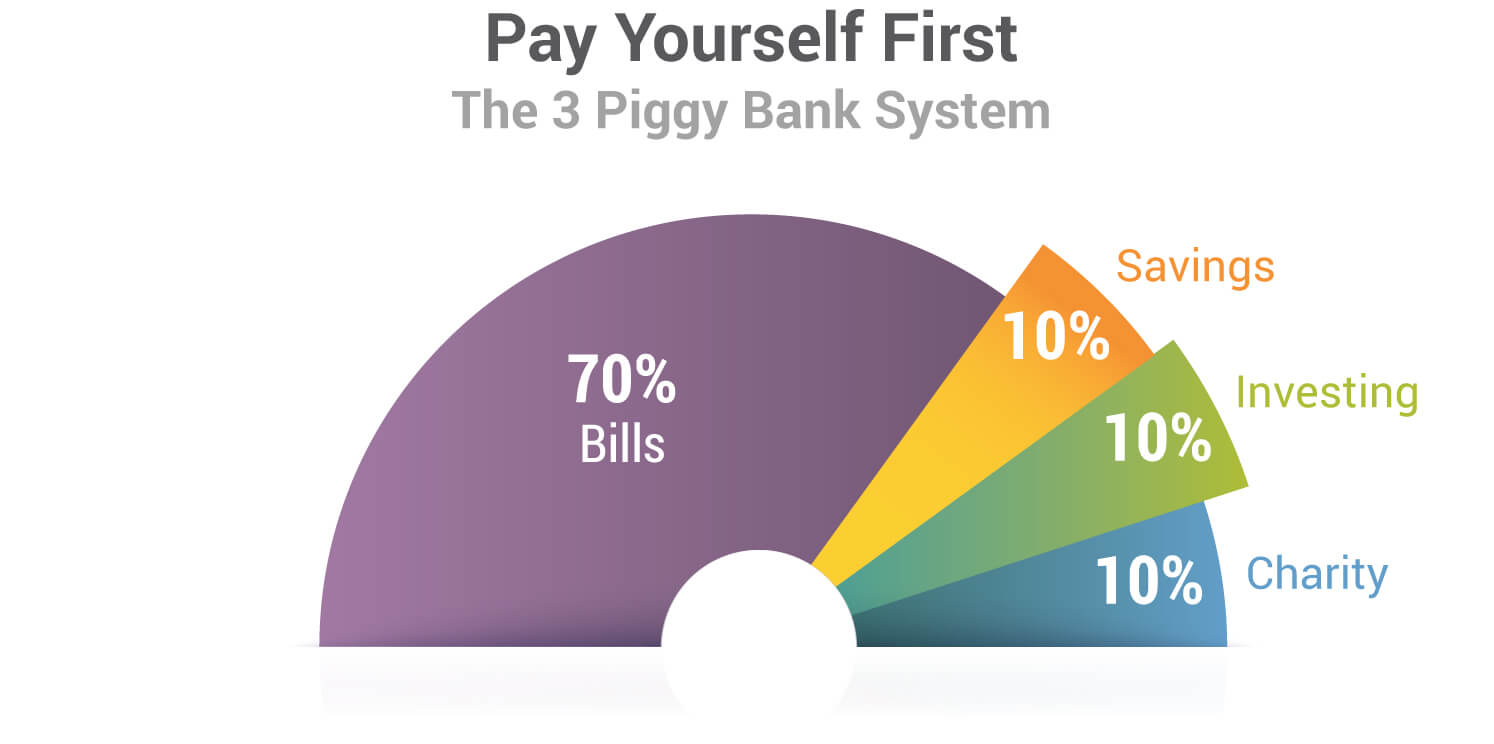

My suggestion to millennial women is to do the same. For every dollar that comes in every month, take 10% and place it into a savings account. Before you do anything else, take an additional 20% and put 10% toward investing in assets and the remaining 10% toward charity. We call it the Pay Yourself First system.

Millennial Money Investing Advice #2: Your financial future is determined with your expense column

This post began recalling the first time I opened a checking account with my mother. I felt so grown up. After graduating from college a few years later I realized that the real world doesn’t care about my grades. It cares about my financial report card.

What is a financial report card?

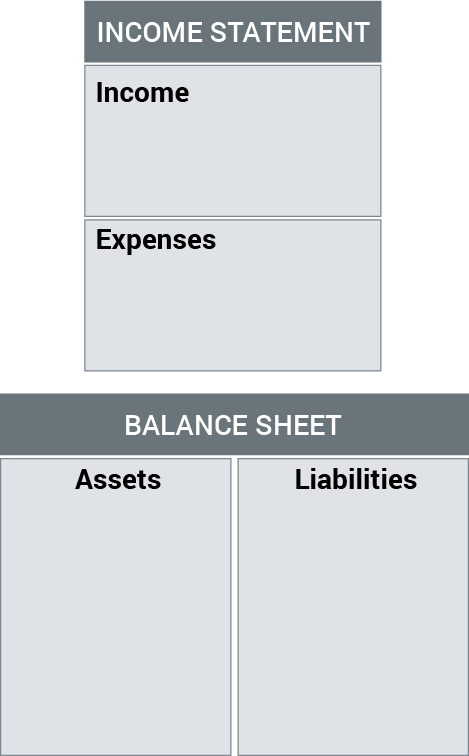

Simply put, an income statement quickly shows you how your monthly income (paycheck from a job, tips, wages, for examples) compares to your expenses like rent, car payment, insurance, Netflix, phone bill, etc.

To see where you’re going to be in the future, you don’t need to look much further than your expense column.

When you look at most people’s expense columns, you’ll see them littered with payments to banks and credit card companies. In each case, none of those expenses go toward anything that creates money and only things that take money out of your pocket. Those are called liabilities.

Millennial Money Investing Advice #3: Acquire assets that pay for liabilities

While most budgeting spreadsheets and tools instruct you to list your monthly income and expenses, there’s more to understanding your financial future than that.

Rich dad teaches the other half of the equation which is the balance sheet.

We’ve briefly discussed assets and liabilities above. An asset is anything that puts money in your pocket, regardless of whether you work for it or not. Dividends from a stock, rental income from a real estate investment, or residuals earned from book sales are all different forms of assets.

Nearly 1 in 5 working women have nothing saved for retirement

CNBC

A liability, however, is anything that takes money out of your pocket. While many people consider their home to be an asset, it’s a liability. Not only do you have the mortgage to eventually pay off, but the property taxes, utilities, and maintenance will always take money out of your pocket.

The key I want millennial women to understand is to acquire assets that then pay for your liabilities. No one loves buying some Prada sandals or Coach handbags more than me. I simply refuse to pay for them myself, that’s what assets are for.

Robert’s rich dad taught me that. If he wanted a new car or bigger house, he would acquire a new asset that would pay for them. The best part of using assets? Not only did he get the new car or house, but he also kept the cash flowing asset.

Robert and I have used this philosophy over and over to buy things we enjoy and increase our wealth in the process.

[If you want to learn more about the personal financial statement, click here.]

Millennial Money Investing Advice #4: Prepare for retirement by spending

When times get tough, most people stop spending on charity, investing, and saving. The rich figure out ways to make more money by spending more money on assets, even when times are tough.

When Robert and I began our businesses over three decades ago, we had our eyes set on one thing: financial freedom. We were able to accomplish our goal in under a decade. Once we had more passive income to cover our expenses, we were free.

When we started out, we were almost a million dollars in debt. We were under constant pressure from family and friends to get jobs. But we knew in our hearts that the only way to financial freedom (and relieved of a ton of debt) would be through acquiring assets. That required following the Pay Yourself First system mentioned above.

But it wasn’t easy. To help us stay accountable, we hired our bookkeeper, Betty. Even though Betty didn’t agree with our plan, she kept us to it. Each month we placed money into our emergency savings, investing, and charity accounts. Our creditors, and there were many, were to be paid from what remained.There were many months when Betty informed us that we weren’t going to have enough money to fund our three piggy banks and the creditors. We used that as motivation to find extra money.

Millennial Money Advice Summary

Do you want a better life for you and your family?

Stop struggling. Take our short quiz and discover how to create a life of freedom.

Take The Quiz Now

Take The Quiz Now

If you want to retire early, then you can’t follow the old rules of money. Though placing money aside for emergencies is wise advice for any generation, it shouldn’t be the cornerstone of your retirement planning. Before you start acquiring cash flowing assets, make sure you continue to invest in your greatest asset—your financial education.

Once you understand how to read your personal financial statement and the power between the income statement and balance sheet, you’ll discover a new confidence in your ability to take charge of your financial future.

Original publish date:

October 24, 2013