Blog | Personal Finance

The Fed’s Worst Nightmare: Deflation!

April 30, 2013

In November 2002, (then) Fed Governor Ben Bernanke made the most important speech of his life. It was called “Deflation: Making Sure It Doesn’t Happen Here”. In that speech he said, “I am confident that the Fed would take whatever means necessary to prevent significant deflation in the United States…” ; and he outlined the “means” he had in mind. First, the Fed would cut short-term interest rates (the Federal Funds Rate) to zero. And, if that didn’t do the trick, it would print money and buy long dated bonds issued by the government and by Fannie Mae and Freddie Mac, in order to push down long-term interest rates, too.

Well, the Fed has cut short-term interest rates to zero. It has also printed more than $2 trillion and used that money to buy long-dated government bonds and mortgage-backed securities, thereby pushing down the yield on long-dated bonds. The yield on 10-year US treasury bonds hit an all time low of 1.4% in July 2012. In fact, the Fed is printing money more aggressively now than ever – at the rate of $85 billion a month since January.

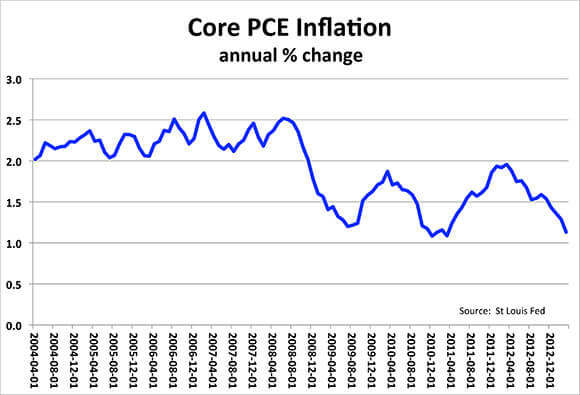

But, IT’S NOT WORKING! Despite the Fed’s best efforts, the threat of the United States sinking into deflation is intensifying. Last month, the inflation index that the Fed watches most carefully, the Personal Consumption Expenditure (excluding food and energy) Index, increased by only 1.1% compared with one year earlier. And, as can be seen in the attached chart, the trend in inflation is decelerating rapidly.

Since 1960, this measure of inflation has never been lower. However, it looks like it will be lower soon. The global economy is very weak and weak demand is driving down most commodity prices. The Financial Times recently reported that Brent oil is down 34%, copper down 31% and corn down 21% from their recent respective peaks. Numerous economic articles have begun to argue that the “Commodities Super Cycle” is over and that prices have further to fall. Sharp drops in commodity prices lead to lower levels of inflation even in those indices that strip out food and energy prices.

Meanwhile, almost all the recent economic data out of the Unites States indicates that increased taxes and reduced government spending are causing the economy to slow sharply in the second quarter. Austerity is also causing the recession/depression in Europe to intensify. Even China’s economy is slowing more rapidly than most had anticipated. In short, all signs are pointing toward a growing danger that Deflation could soon take hold in the United States as it did in Japan more than 20 years ago.

The question, literally the trillion-dollar question, is: What Is The Fed Going To Do About It?

I feel pretty certain they are going to do something. As I wrote in my first book, "The Dollar Crisis", deflation is the Fed’s worst nightmare. Bernanke has staked his reputation on the Fed’s ability to prevent deflation. I don’t think he will stand by idly while his “Bernanke Doctrine” (to coin a term) is proven to be false.

The odds are rapidly rising that the Fed will soon once again increase the size of QE 3. In mid-April, James Bullard, a voting member of the Fed’s Federal Open Market Committee, publicly stated that he would support such a move if inflation continued to weaken. Alternatively, the Fed may attempt to pull a new trick out of its hat. Chairman Bernanke once mentioned dropping money from helicopters. Don’t underestimate how far he will go to prevent deflation… and to defend his reputation. Deflation would ruin him.

The Fed is meeting now (April 30th to May 1st). It’s statement at the end of its meeting on May 1st could set off fireworks in the financial markets. If the Fed does announce any kind of additional monetary stimulus, stocks and gold are likely to rise and the dollar is likely to fall (in the near term, at least). If no additional stimulus is announced on May 1st, keep an eye on the core PCE price index when it is released at the end of May. It may show the lowest rise since 1960. If so, the chances of additional stimulus from the Fed at its June 18th – 19th meeting will jump sharply.

Finally, on a personal note, I would like to thank all of you who have signed up to watch my course, Capitalism In Crisis. For those of you who have not, I would recommend that you do. The offer’s still open. Please click on the following link for details:

http://www.richdad.com/Resources/Updates/capitalism-in-crisis-he-global-economic-crisis.aspx

Original publish date:

April 30, 2013