Blog | Personal Finance

Disaster Averted?

January 01, 2014

Three years ago, just as the second round of Quantitative Easing was being launched, I wrote a blog entitled, The Future: Averting Disaster.

There, I wrote:

The future – the happiness and prosperity of mankind – will be determined by how global supply and global demand are brought back into balance. If the means are found to expand aggregate demand sufficiently and sustainably, then the global excess supply will be absorbed and the global economy will begin to grow again. If, on the other hand, equilibrium is restored by a collapse in supply – back to a point at which there is real demand, a point determined by the current income and purchasing power of the individuals who comprise the world’s population – then globalization will collapse and the world economy will plunge into depression.

The outcome will be decided by government policy. The current government policy of supporting global aggregate demand by borrowing, printing and spending trillions of dollars without correcting the imbalances at the heart of the crisis are unsustainable and they will fail.

Either there will be a political backlash against free trade or the Fed will create so much new money that inflation will accelerate causing a stock market, bond market and dollar crash. Either way, within five to ten years, the US economy will collapse in depression and drag the global economy down with it.

If disaster is to be averted new policies must be crafted and implemented.

So, three years on, how do things look now? Are we still on course for a new great depression or has disaster been averted? Let’s consider what’s happened since that blog was written.

The government has not adopted the new policies I advocated. Instead, it stuck with its old policy of “supporting global aggregate demand by borrowing, printing and spending trillions of dollars without correcting the imbalances at the heart of the crisis”.

Since the end of 2010, the government has borrowed $3 trillion more to fund its budget deficits and the Fed has printed $1.5 trillion more to help finance those deficits. When QE 2 failed to generate sustainable growth, QE 3 was launched.

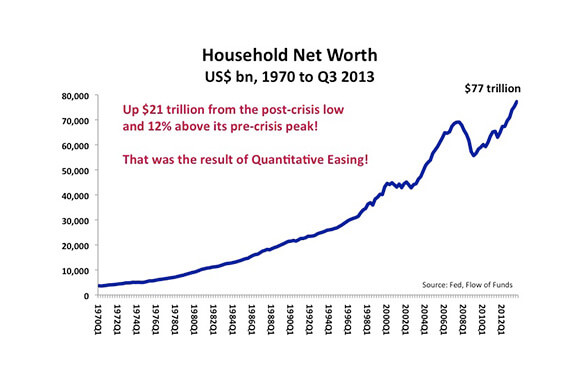

By reapplying its old policy, the government created a new asset price boom. The Fed fuelled a stock market rally and reflated the property market by printing money and buying financial assets. As a result, household sector Net Worth soared to $77 trillion by the third quarter of 2013. That was up $21 trillion from the post-crisis low and 12% higher than the previous peak set in mid-2007. That “creation” of wealth financed a pick-up in consumption that has made the economy grow. The Fed used exactly the same strategy to reflate the economy after the NASDAQ bubble popped back in 2000. It inflated property prices and blew the property market into a bubble.

The Fed intends to continue pushing up asset prices to drive economic growth; and, it looks to me that it should be able to succeed in doing that for the next few years. It will not be easy to keep asset prices inflated over the long run, however. As I have written before, economic bubbles are easier to create than they are to sustain. The problem remains Income. Real disposable personal income remains depressed because globalization continues to push wages down. If income does not rise, then it becomes impossible for the public to make the interest payments on the debt it used to acquire the inflated assets. That is why bubbles always pop. During the boom, asset prices increase much faster than income grows. Eventually, the imbalance becomes unsustainable and the boom busts.

So, it appears that we can expect yet another asset price bust a few years hence. That’s the bad news. No new policies were implemented to bridge the gap between supply and demand in a sustainable way. Instead, another asset price boom was orchestrated to create demand in the short term.

Not all the news is bad, however. In 2013, the US budget deficit was half the size it was in 2009 ($680 billion vs. $1.4 trillion, respectively). The US current account deficit is also improving rapidly – thanks primarily to the Shale Oil Revolution. And, finally, the best news is that QE 3 did not drive commodity prices higher as I had feared it would. In fact, even though the Fed has created $1 trillion of new fiat money this year, commodity prices are actually falling sharply. This is hugely important.

It suggests that the government’s old policy of “supporting global aggregate demand by borrowing, printing and spending trillions of dollars” may be able to continue considerably longer than I imagined three years ago. I had feared that QE 3 would result in soaring food prices and lead to severe political unrest when the world’s three billion poorest people could no longer afford to eat. Mercifully, that has not happened; and the absence of high rates of commodity price inflation has bought us time. For the next few years, at least, it looks as though the government can continue to borrow and spend more, and that the Fed can print more to finance the government’s borrowing.

This does not mean that the global economic crisis is over, however. The core of the problem remains. Global supply greatly exceeds global demand, which is limited by actual income. A new asset price bubble is being inflated in the United States, but it is far from certain how long that can be sustained. Credit growth (which has driven economic growth in the US for decades) remains too weak to drive the economy now; and with wages under pressure due to globalization it is difficult to see how that will change. Moreover, Europe and the UK face the same constraints. Consequently, the growth in world trade is particularly weak and many of the countries dependent on export-led growth are showing signs of serious strain. China’s economy seems to be hurtling toward crisis, while Japan’s prospects also appear increasingly precarious.

So, as we enter 2014, it is important to take note of developments in the economy that have turned out better than anticipated. Doing so should not blind us to the serious dangers that still remain, however. So long as we fail to find a way to make aggregate demand (in other words, income) rise in line with the supply of goods, the global economy will remain at risk of collapsing into a new depression.

Original publish date:

January 01, 2014