Blog | Paper Assets, Personal Finance

Here’s The Problem

June 17, 2013

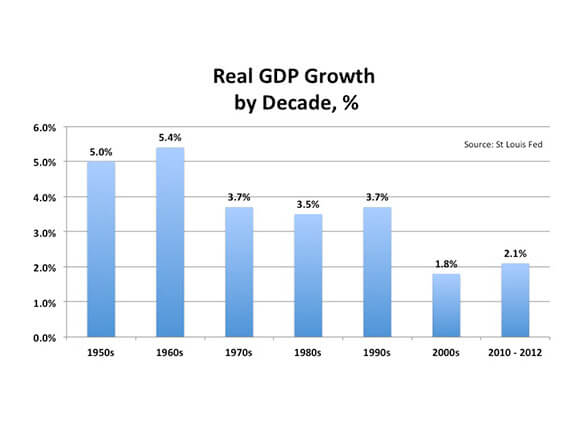

In order for an economy to grow, one or more of the following things must happen: the workforce must expand, wages must increase or credit must grow. That is because, ultimately, the size of every economy is determined by the size of the population and by how much the people spend. The problem with the US economy is that none of these things is increasing enough to generate a satisfactory rate of growth. Worse still, there is little reason to believe this is going to change within the foreseeable future.

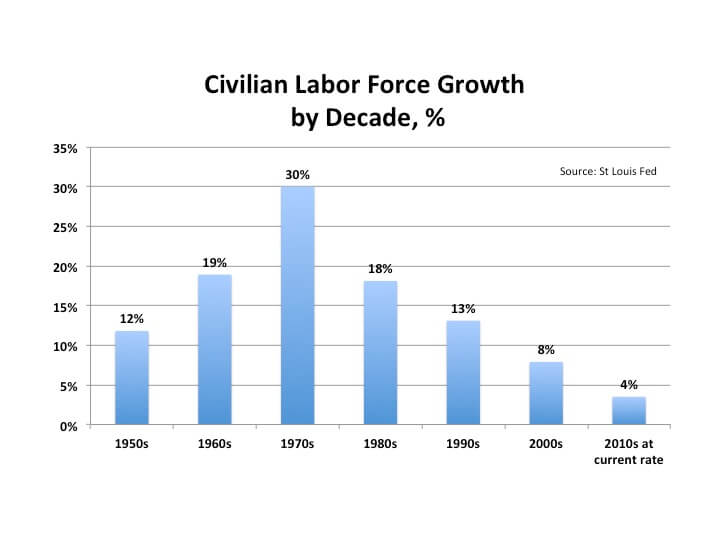

The growth rate of the US workforce has slowed sharply in recent decades and is now barely growing at all.

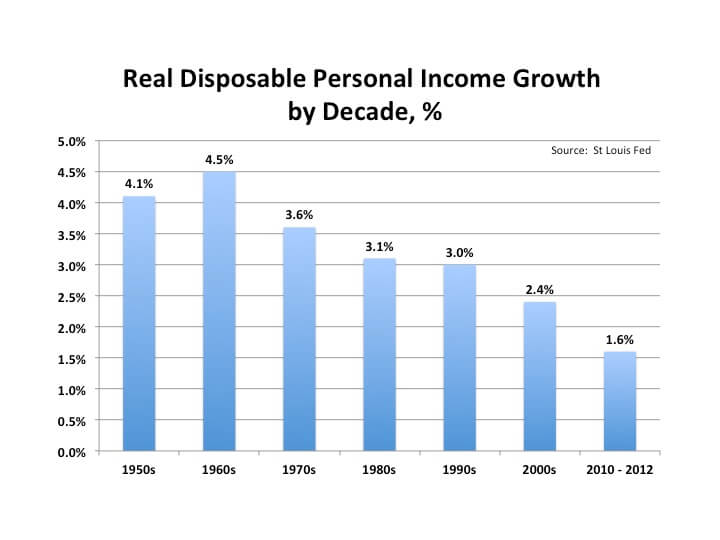

Meanwhile, globalization has put extreme downward pressure on US wages. Real median income was the same in 2010 as it was in 1989. With the size of the workforce slowing and median income not growing at all, the rate of growth in real disposable income has naturally been slowing as well.

During the first three months of this year, real disposable income was up only 0.7% compared with the same period last year. Real personal consumption expenditure grew slightly faster, by 2.1%; but that was only possible because people saved less. The personal savings rate averaged 2.3% during the first quarter of this year, more or less an all time low.

From 1980 to 2007, total credit as a percentage of GDP expanded sharply; from 170% to 360%. The rapid expansion of credit contributed enormously to the economic growth during recent decades. In fact, credit growth was the driver of economic growth. Even still, the credit boom was not enough to sustain the rate of economic growth experienced during the 1950s and 1960s.

Then, in 2008, even credit ceased to expand. That occurred because the private sector simply could not bear any more debt and began to default on the debts already incurred. Since 2008, the size of the workforce has barely budged and median income is actually falling. The Fed is desperately trying to make credit expand again by printing money and pushing up the value of property and stocks. Higher asset values create more collateral, which should allow more borrowing.

Asset prices have indeed begun to rise. Household Net Worth is now $70.3 trillion, $3.5 trillion above its previous peak set in 2007. Credit, however, is still not expanding enough to make the economy pick up. During the first quarter, total credit expanded by 3.6% compared with one year earlier. Adjusted for inflation, that’s about 1.6% growth. Between 1952 and 2007, every time total credit (adjusted for inflation) grew by less than 2%, there was a recession.

Looking ahead, there is little to suggest that the size of the workforce or median income will soon begin to expand again. Nor should we expect a rapid pickup in credit growth. Household sector debt is still contracting and now the rate of growth of government debt is set to slow sharply due to sequestration and the recent tax increases.

With almost all the recent economic data coming in weak, the Fed must feel that it has little choice but to continue printing money in order to drive property and stock prices higher, in the hope of causing credit growth to revive. Recently, the market has begun to speculate about when the Fed will begin to “taper off” the amount of money it prints each month. That speculation looks premature. Quantitative Easing is the only thing keeping the economy afloat. If the Fed does significantly reduce QE any time soon, a new recession would almost inevitably result. In fact, we may soon once again be in recession even if QE continues.

Original publish date:

June 17, 2013