Blog | Personal Finance

7 Steps to Reach Your Financial Goals

Warning: This methodical approach to achieving your financial goals only works if you stay true to yourself

Rich Dad Personal Finance Team

September 19, 2023

Summary

-

Achieving your financial goals means stepping out of the roles you play for others

-

Identifying your “why” is the first step in achieving your financial goals

-

The journey toward achieving any goal can be categorized into just seven steps

We all have a dream that we someday hope to achieve. This is true when it comes to your financial dreams, too.

If you’re reading this article, it’s likely because you’re looking for ways to achieve your financial goals. Yet, many people are stuck wondering how to actually make that happen. The problem is that while people are crystal clear on their desired outcome, they haven’t been able to wrap their heads around how to achieve it—probably because no clear-cut road map to nirvana exists. There are so many variables for each person’s unique situation that there just isn’t a one-size-fits-all plan that will work.

Stepping out there and going after your financial dreams takes guts. It takes daring, chutzpah, strength of character and, above all, the ability to laugh. Call it what you will, but the game of money is not for whiners, sissies, or teacher’s pets.

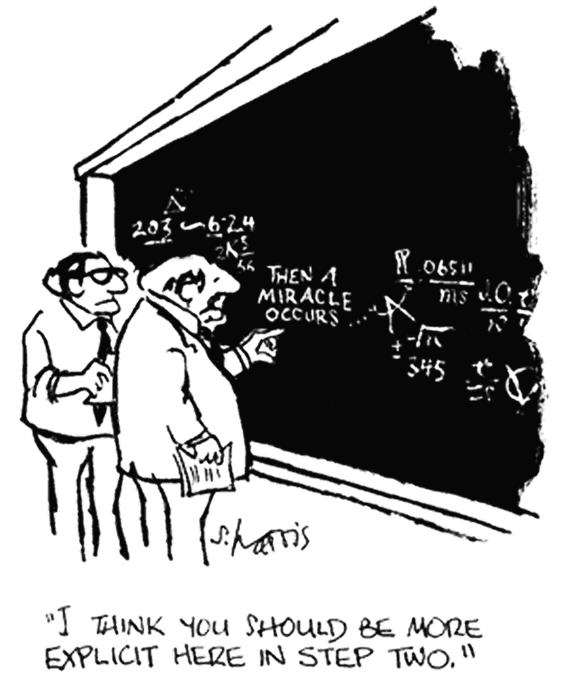

We’ve all seen the TV ads and infomercials promising you "financial freedom" for five easy payments of $29.99. Really? There seems to be something missing.

Kind of like this cartoon:

You Are the Miracle

If you’re looking for a financial savior to come to your rescue, guess what? Tag, you’re it.

Not that you’ll be figuring out this “miraculous equation” all by yourself, of course — in fact, it’s just the opposite. You will definitely want and need a support structure of friends, experts, brokers, mentors, and teachers with you along this journey.

This is your journey, and you are the architect. Only you have the power to change your trajectory and change your future.

However you choose to embark on the journey of achieving your financial dreams, your success depends on one very important factor: You creating what you want and figuring out how you will get there in a way that fits your values, your spirit, your interests, and your passion.

In other words, it all comes down to you.

Being True to You

It’s time for you to be true to yourself. It’s not time to be who people want you to be. It’s not time for you the mother or wife, or you the father or husband, or you the artist, or you the homemaker, or you the best friend, or…you get the picture.

Who are you? Your innermost person — your spiritual being, who is that?

How do you know when you are being true to you? You can tell because magic happens. Things just seem to go right. You think a thought, and it manifests instantly. You are “in the right place at the right time.” Things occur effortlessly. You are happy and enjoying life. That is the true you.

Be True to Your Financial Life

How in the world does “being true to you” fit into money, finance, and investing? Simple. Your plan has to fit you, not the dreams of your parents, your siblings, your spouse, or your friends. It’s time to accept the simple fact that your reward of financial freedom really demands that you stay true to your values, your loves, your dreams, your talents, your wit, your silliness, and everything that makes you, you.

This is a big dream. And it will take all of you. It will test you at times. If you’re doing this for anyone other than you, then you won’t make it. You will quit. You must be internally motivated to accomplish this — that’s why your “why” is so important. This is why your reason for pursuing your dream, your purpose for your financial journey, has to be what you really want deep down in your heart and soul. It’s your drive and passion that will get you through the rough patches, the doubts, and the setbacks. But every success you experience will propel you forward.

7 Steps to Achieving Your Financial Goals

Ok, once you’ve zeroed in on your “why” and gotten a very clear picture of what is authentically you, it’s time to take that first step. And — this may shock you — there are only seven steps in total you need to take. That’s right: the basic steps of what everyone needs to do are essentially the same.

That’s because the journey toward achieving any goal — from financial freedom to weight loss — can be categorized into just seven steps, one leading to the next. Sure, the details within each of these seven steps will vary, but you can still use these broad classifications to get organized and begin moving forward.

So let’s dive into the seven steps you can implement in your life, starting today, to achieve your financial goal.

- Know your destination.

What is the ideal life you want to create for yourself (and your loved ones)? What do you need — in financial terms — to get there? Don’t be afraid of making too bold of a statement here. Go big or go home, ladies!

- Create a plan.

Next you’ll need to map out a plan to your destination. Why? Because a goal without a plan is just a wish.

Dr. Gail Matthews, a psychology professor at the Dominican University in California, conducted a study on goal setting. She divided the participants by those who wrote down their goals and those who didn’t. Her findings? More than 70 percent of the participants who sent weekly updates to a friend reported successful goal achievement, compared to 35 percent of those who kept their goals to themselves, without writing them down.

Your plan may need to be revised along the way as you encounter new or unexpected situations (including surpassing your goal), but you should always have a plan. And you should always write it down and share it with a friend or mentor who believes in you. This will help hold you accountable when you lose your way (which will happen from time to time).

- Break it down into manageable steps.

Enormous goals can be incredibly intimidating. Pretend you’ve decided to run a marathon, even though you’ve never run a day in your life. Well, just thinking about running 26.2 miles is beyond overwhelming. But nobody starts there. You start with one mile, and train for months. Maybe years. You keep adding more miles to your run. And eventually, you can run the entire 26.2 miles without taking a break — a chore that likely seemed insurmountable in the beginning.

The same rules apply to attaining your financial goals: Set yourself up for success by breaking your big goals down into smaller and smaller goals until they are manageable and achievable. Plus, crossing each one off your list (because you wrote it all down, remember?), no matter how small, is so satisfying!

- Do at least one small step every day.

Now that you’ve got those manageable goals, make sure you work on them regularly. Develop a habit of accomplishing at least one task each day that moves you toward your end goal. That momentum is so much harder to regain once you lose it.

- Take advantage of organizers and reminders.

Whether you prefer electronic tools, written reminders and lists, or a combination of both, utilize tools to help you stay organized and keep you on track.

- Make learning a habit.

Keep increasing your financial intelligence every day. Most CEOs read a book a week — imagine how much you’d learn if you committed to just one a month. Start with with Rich Dad Poor Dad or It’s Rising Time and then branch out into your special area of interest from there. The more you learn, the more your confidence will soar and that will keep you motivated and creative.

- Build your team and your network.

Your team will consist of professionals who help you find, analyze, and pursue opportunities. Your network will consist of those people in your life who encourage you and understand and support your goals. But be sure to choose wisely. Motivational speaker Jim Rohn firmly believes that the five people you spend the most time with shape who you are.

So, while we might interact with many people, it’s the handful who are closest to us who have the greatest impact on our thoughts and decisions. So don’t just hang out with people who are busy complaining about their finances and doing nothing about it —find other kindred spirits on your same journey, or people who have already succeeded.

People all over the world have reached their financial goals, and you can too. Please use these seven steps to your advantage and watch how easily everything begins to flow once you take that first step.

Original publish date:

March 29, 2018