Blog | Cryptocurrency, Personal Finance

Old Investor vs. Young Investor

August 02, 2020

Gold became money as determined by the free market because of its properties—scarcity. But with the invention of Bitcoin, we are now seeing a historical event that will never be repeated. What makes Bitcoin so special is that prior to Bitcoin there was no other form of money with its absolute limited supply.

Bitcoin’s characteristics make it a direct competitor to the central banks because of its absolute scarcity, resistance to theft and confiscation, and the system that it’s built upon prevents it from being shut down.

Why am I so interested in Bitcoin and cryptocurrencies? The same reason I love gold and silver, they free my money from State control.

I've heard so many opinions on the the subject of cryptocurrency. For example, I’ve heard that Warren Buffet won't touch Bitcoin. But, Buffet doesn't touch gold either. And then there's guys like Ray Dalio and my good friend, Jim Rickards, who do not support Bitcoin and cryptocurrencies. But, I noticed one thing, they're all old guys.

I know there are three sides to every coin, the head, tail and the edge. Wisdom is found on the edge. On one side of the coin we have the “old” guys who won’t even consider Bitcoin and cryptocurrencies, on the other side of the same coin we have the younger guys, who don’t trust the system and the Federal Reserve and they will only invest and buy crypto. My job is to stay on the edge, philosophically, and gain the knowledge both sides possess so I can strike and profit when the time is right.

So, on the edge, we just keep an open mind. In this blog we are going to dig deeper into cryptocurrencies – not just Bitcoin – and learn from a young genius how to profit from the world of crypto.

Before I ask a brilliant man, Jeff Wang, to explain the “crypto” side of the coin, I want to give you a very brief view of the “old guys” side of the coin.

Recently, I have been adding to my gold stash. Why? Two reasons. First, whenever there is chaos in the world investors get afraid and look to move their money and investments into the safest place. That place is considered gold by many. Second, gold is outside the Federal Reserve and its heavy handed manipulations. As the Fed tries to manipulate the dollar, the stock markets and real estate it causes an infection. An infection of our assets. The safe place from this infection is to invest in the world outside of the Federal Reserve, mainly gold, silver and cryptocurrencies.

That said, right now I have stopped buying gold. It is at its all-time high and should stay high for some time. Silver is where I see the best play for the “old” guys. Silver is more important than ever as it is used in electronics, technology and as a powerful anti-bacteria, which in the “Cornoa-Verse” we live in today, is a huge reason to look at silver. Here is my most recent Tweet about silver:

One of the greatest characteristics of silver is its affordable enough for most and, it has a huge upside.

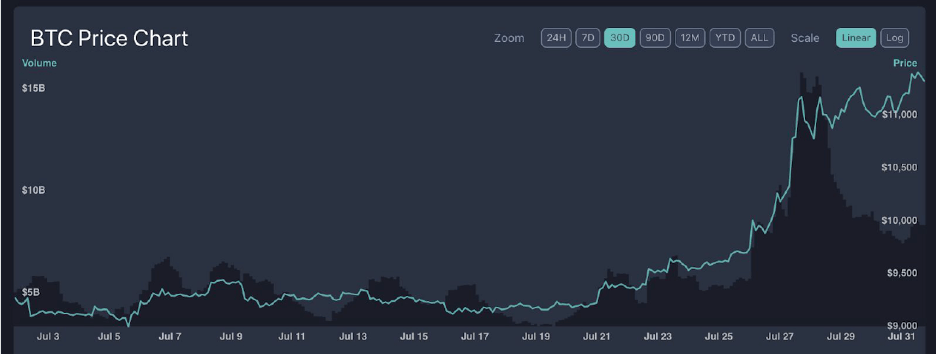

In the cryptocurrencies field the two biggest players are Bitcoin and Ethereum. Bitcoin is around $10k as I write this. It is very similar to gold. It is the “king” in it’s space. It’s the original, it is expensive and it has very little practical use in the modern world. It’s not really a currency as very few people can or do use it like money. It’s more like gold, you buy and hold.

Ethereum is very different from Bitcoin and very similar to silver. And it may be a great opportunity right now. I’ve asked my expert Jeff Wang to explain the Ethereum opportunity to you.

Jeff Wang

Thank you Robert. As you’ve always taught me, I’d like to start off with a big picture and then move down into the Decentralized Finance (DeFi) projects and Ethereum opportunity.

After weeks of DeFi projects surging (keep reading I’ll explain what this is… it is very exciting), Ethereum and Bitcoin finally broke out of their shells.

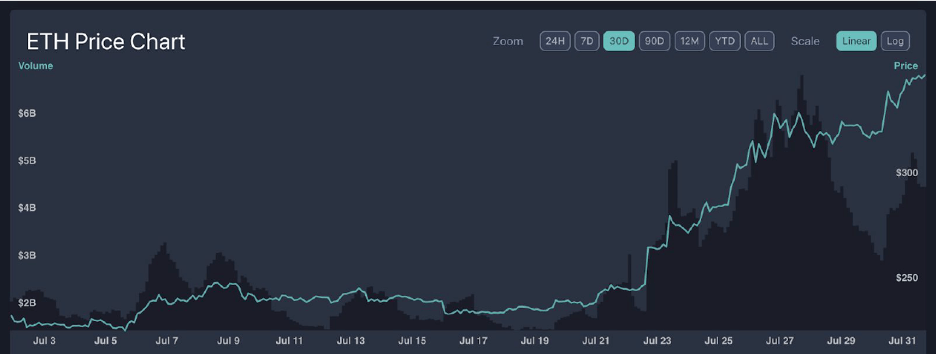

(Ethereum price chart, July 2020)

(Bitcoin price chart, July 2020)

Notice that right now, Ethereum is driving the current crypto rally (Bitcoin only jumped after), and that is because most if not all major DeFi projects are actually built on top of Ethereum.

If you were to check every RocketFuel newsletter in the past several months, I have dedicated a section to explain what DeFi is and I’ve dedicate each one to a specific “sector” in DeFi. In short, DeFi deserves its own section but is the primary factor behind this whole bull run.

Nearly all of my suggestions last month had huge breakouts, with many of them even surpassing the price targets by a lot, especially Ethereum’s $300 target, which I believe will keep going. [note: if you follow my newsletter, this month I will be pivoting, in detail, to other lesser known projects in the DeFi space.]

Before we get there however let’s discuss what’s going on in the world.

In a macroeconomic sense, the United States Senate has recently come up with their version of the next trillion dollar stimulus package.

In various projections, the USD is not looking like it is getting stronger anytime soon, and other signals like Gold and Silver reaching all-time highs (more on this later) are further reinforcing that capital is seeking safe havens.

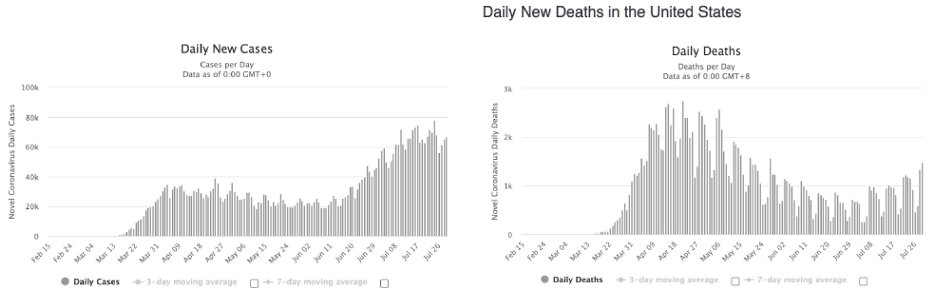

The coronavirus fears are still at the peaks, with states still hitting record highs in deaths, but with cases starting to slow at least:

(Cases have finally flattened in the United States and Deaths are increasing due to lag time from cases)

Google was the first company to announce work from home until next summer, one year from today, which sets an expectation of things to come, and that the economy is not opening potentially for even another year.

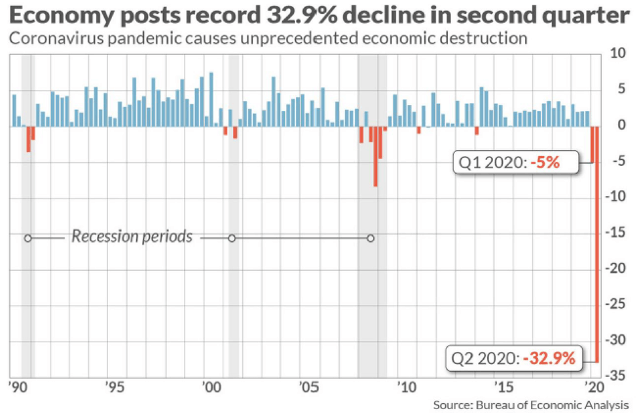

GDP recorded a record shattering -32.9% decline in Quarter 2, with most travel, retail, hospitality companies in jeopardy (especially if we are still one year away).

Meanwhile, the stock market is at record high, which we explained in the last newsletter, driven primarily by lack of alternative investments, zero interest rates, and bias towards tech stocks dominating the scene. In fact, with tech giants Apple, Google, Facebook, and Amazon testified at an antitrust hearing this week, and reported earnings the next day, all shattering expectations (with the exception of Google/Alphabet). Apple actually rose 10% today ($180B!!!).

Overall, the next few months look pretty grim for the economy, but with people sitting at home trying to figure out what to do with all their newfound savings, it is likely that there will still be an influx of capital to both stocks and crypto. That is of course if things get resolved with the unemployment benefits going away today (the expectation is set to be renewed but lower dollar amount).

The prediction that July was the month to decouple from the stock market was correct.

Gold surge

(Gold Chart, from 1971 to today chart)

Gold reached an all time high, hitting $1973, along with a similar chart in other precious metals, during this time, Bitcoin also started heading up higher (behind Ethereum), indicating some sort of correlation between Bitcoin and Gold.

Okay, now that we’ve caught up, there’s a ton to talk about what is going on with this month.

Decentralized Finance (DeFi) Madness

This month had a couple of DeFi projects go crazy with gains so it’s impossible to ignore. Last month we talked about Compound and other clones creating borrowing and lending pools, where people could deposit Ethereum for interest, and borrow it for higher interest, thus creating an ecosystem of people hunting for returns.

Compounding (no pun intended) on top of this, reward tokens were created (like COMP, LEND, SNX), to incentivize people to participate in these networks regardless of the gap in returns, making profitability almost a certainty. Thus, a massive bubble began, with the reward coins in the space going up several hundred percent each. It’s impossible to have guaranteed returns in perpetuity, so things have since calmed down.

But not really… now comes something new on top of Ethereum. With the existence of smart contracts and decentralized exchanges, people could create their own platforms of this by creating a new token, have pools to deposit money, either for lending, or for liquidity in trading, and then earn rewards.

Before I get into this... a fair warning...

ICO 3.0

This is just like the initial coin offering (ICO) bubble in 2017, where many projects started appearing out of nowhere, and almost all of them started giving back 5-10x returns. This is because when a new trend occurs, there is a lot of speculative money that quickly gets thrown in without research.

However, as people soon realized, many of these coins were essentially worthless, and these huge fundraises soon started giving back negative (and eventually really negative) returns. Some of these pools are directly scams as well.

In a sense, it is like a slow moving Ponzi scheme, when capital floods a new market, the value of things increase exponentially. There is no valuation technique, only capital flying in. It only keeps going up when more and more capital comes in and nobody cashes out. That’s why it’s very important to distinguish between what looks to be a cash grab, and what could actually have value in the long run, and to set expectations that a steep drop could happen at any time.

After the ICO came the Initial Exchange Offering (IEO), where exchanges took the guesswork out of these coins, and these also spiked up 5-10x upon listing. However, eventually fewer and fewer projects were legitimate for these, and they eventually stopped appearing as well.

Now entering the DeFi craze, we are in a period of new capital flooding in, and similarly to 2017, Ethereum is boosting up like in 2017 when it went to $1000 because so many people wanted to place bets on the next ICO. The difference this time however, is it is happening in much faster motion. The reason why is because it is very easy to clone one of these projects, create pools, and then start accepting Ethereum into those pools.

Someone can do these in a very short period of time, which is dangerous because the next step would be to put out convincing marketing to send Ethereum into those networks.

I just wanted to get that out of the way before I go into some detail, this is a speculative area of crypto, which is saying a lot! Enter at your own risk. Ethereum is a safer play, as it swings less than the DeFi projects built upon it.

Robert Kiyosaki

Thank you Jeff. That is the “youth" or "Crypto” side of the coin. One thing that Jeff stated, that I think I need to learn more about, is the way Ethereum is used. Ethereum has so many similarities as silver. It is:

-

Less glamourous than its big brother, Bitcoin.

-

Has many practical uses

-

Costs less than its big brother

-

The upside appears to be huge

One of the things I found interesting about Jeff’s contribution is the mindset of his statement, “Ethereum is a safer play, as it swings less than the DeFi projects built upon it.” It reminds me of two other examples where it was wiser to invest in a huge trend by investing on the trends foundation rather than the trend itself.

The first example is Apple. When the iPhone took off and changed the world many financial advisors and “experts” recommended buying Apple stocks. And they were right. Apple stocks soared. But it was risky, what would have happened had Apples batteries exploded (remember Samsung’s Note)? The stock would have crashed.

The smarter, and bigger play, was to invest in the microchip manufacturer of the iPhones. That stock soared at a much higher percentage than Apple’s ever did and since they also made chips for other companies, their stability was not reliant on the luck of one product or company.

Is Crypto Legit?

Are you interested in protecting yourself from the dying dollar... but find yourself unsure about cryptocurrencies like Bitcoin or Ethereum? Take a few minutes to educate yourself from the only cryptocurrency guy Robert and Kim Kiyosaki trust.

Start Investing in Cryptocurrencies

Click Here

Another example is Tesla. Again, very popular and huge growth potential but dangerous. The more profitable and less risky play was to research and invest in their lithium suppliers. Lithium is the main material in their batteries.

So when Jeff, looked at the DeFi projects and quickly surmised that a great way to invest in them without the same risk level was to buy Ethereum, I was very impressed.

Remember, never invest without being educated first. Look at both sides of the coin. Read why Warren Buffet does not like cryptocurrencies and then read why people like Jeff see them as a great opportunity. If you agree with Jeff’s point-of-view then I recommend subscribing to his video newsletter to further your education.

Original publish date:

August 02, 2020