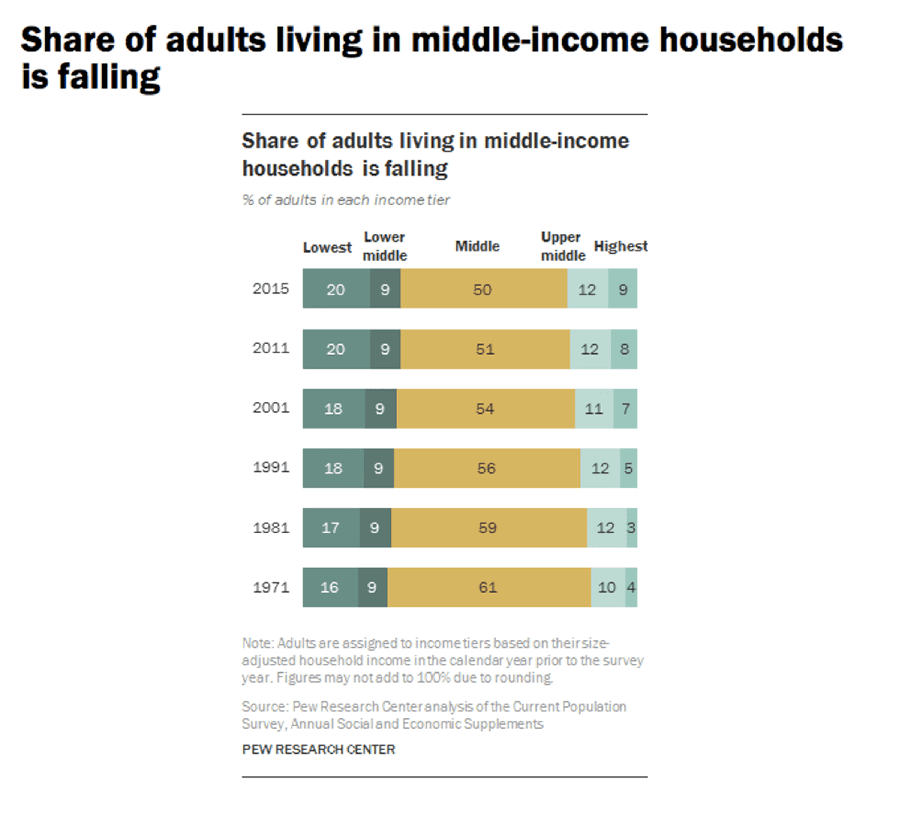

Back in 2015, Pew Research Center published this sobering graph.

The share of adults living in middle-income housing is dropping.

As you can see, from 1971 to 2015, the share of adults living in middle-income households fell from 61% to 50%.

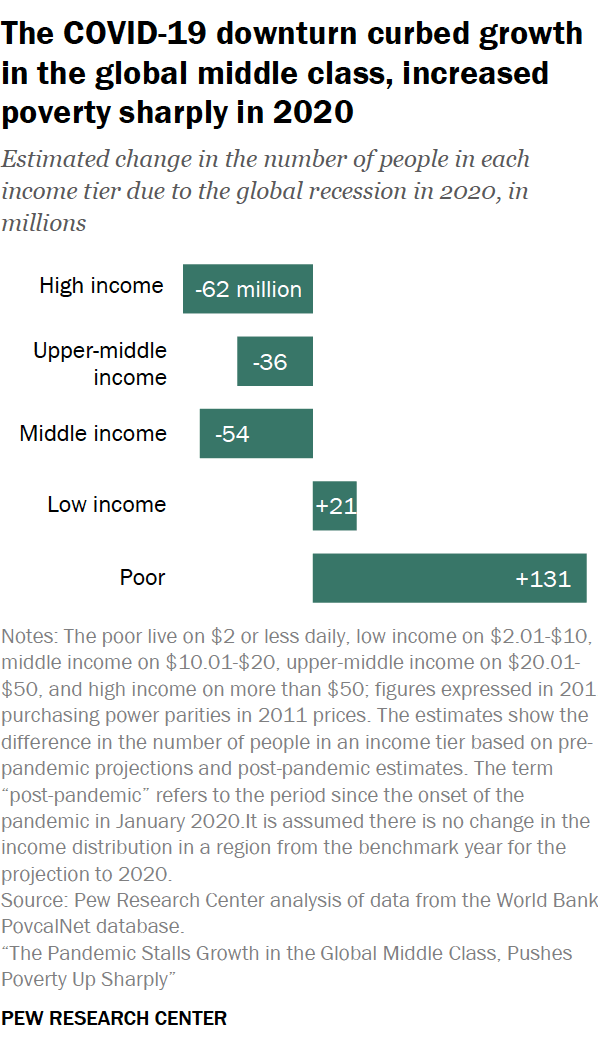

Since this was last published, we’ve gone through a global pandemic, record inflation, and now the threat of war spilling out from the borders of Russia and Ukraine. This has not been kind on the poor and middle class according to recent research by Pew.

In a country where the rich are getting richer and the poor are getting poorer, the straw is finally breaking the camel’s back. That is why candidates like Donald Trump and Bernie Sanders gained so much traction against traditional party politicians in the last election cycles. It is why we are seeing so much polarizing discussion and violence. The American middle class is the spark that is lighting a powder keg of dissatisfaction.

The growing wealth inequality gap

As you can tell, the decline of the middle class has happened for a long time and steadily since the 70s. Over the last four decades, there have been forces at work that steal wealth from the middle class and give it to the rich.

Much of the anger in our country comes from the fact that people are being financially ripped apart by these forces. Yet, they are not truly aware what those forces are exactly or what to do about them. All they know is that they want change.

Yet, if they understood those forces and what to do about them, they would be able to take matters into their own hands rather than hope a politician would fix their problems for them.

Here are the four financial forces that cause most people to work hard and yet struggle financially.

- Taxes

- Debt

- Inflation

- Retirement

Take a moment and reflect briefly on how much these four forces affect you personally.

Wealth-stealing force #1: Taxes

America was relatively tax-free in its early days. In 1862, the first income tax was levied to pay for the Civil War. In 1895, the US Supreme Court ruled that an income tax was unconstitutional. In 1913, however, the same year the Federal Reserve System was created, the Sixteenth Amendment was passed, making an income tax permanent.

The reason for the reinstatement of the income tax was to capitalize on the US Treasury and Federal Reserve. Now the rich could put their hands in our pockets via taxes permanently.

The secret of the rich when it comes to taxes is that they know how to use taxes to get richer. In fact the entire tax system is built to benefit the rich. That is why the highest tax rates are for earned income (i.e., salary) and capital gains (i.e., house flipping and day trading), while the lowest tax rates are for passive income and business.

I talk a lot about this with the CASHFLOW Quadrant. Those on the left side of the quadrant, Employees and Self-Employed, pay the most in taxes and those on the right side of the quadrant, Business Owners and Investors, pay the least.

There is a difference between being rich and being wealthy. For instance, the higher your salary as an Employee, the more you pay in taxes. But the truly wealthy know how to make millions without paying any taxes. This is why I actually praised Donald Trump when he was running for president when Hillary Clinton tried to shame him for paying nothing in taxes.

All Hillary did was prey on fear and ignorance. If people truly understood the tax code, they would celebrate wealthy people paying nothing in taxes because it means they’re doing exactly what the government wants—creating jobs and building the economy through business and investing.

The good news is that you can leverage the tax code in the same way…if you’re financially intelligent.

Wealth-stealing force #2: Debt

When I was a young man, my rich dad taught me one of life’s most valuable financial lessons—the difference between good debt and bad debt. Like most things, debt in and of itself is not bad. It’s how you use debt.

My rich dad explained it this way: “Many things can be both good and bad depending on how you use them. For instance, drugs can be good if they’re prescribed by a doctor and taken according to direction. They can be bad if you overdose on them. Guns can be good if you understand gun safety and use them for sport or to protect your family. They can be bad if a bad person uses them to commit crimes. And debt can be good if you are financially intelligent and use debt to create cash flow. It can be bad if you’re financially unintelligent and use it to acquire liabilities. All things can be good or bad depending on how you use them.”

When people say one thing is always bad, they do so either out of fear and ignorance or to take advantage of someone else’s fear and ignorance. So, when so-called financial experts tell you that debt is bad, they’re appealing to their reader’s fear and ignorance—and possibly exposing their own.

Many of these experts know the difference between good debt and bad debt. In fact, they probably use good debt to further their businesses. But they withhold that information from their readers because it’s easier—and more profitable—to preach the conventional wisdom of go to school, get a good job, save money, buy a house, and invest in a diversified portfolio of stocks, bonds, and mutual funds.

There is a perceived risk with using debt, and so, rather than educate, many choose to placate—and collect a buck in return. The problem is that the old financial wisdom, the old rules of money, is riskier than ever. Savers are losers and the middle-class is shrinking.

The rich use most people’s fear of debt to get richer. The reality is that our economy is built on debt. Banks use debt to leverage deposit money by many multiples in order to get richer. The Federal Reserve System gives politicians the power to borrow money, rather than raise taxes.

Debt, however, is a double-edged sword that results in either higher taxes or inflation. The US government creates money rather than raising taxes by selling bonds, IOUs from the taxpayers of the country that eventually have to be paid for with higher taxes-or by printing more money, which creates inflation.

Unfortunately, most people use debt to buy things like cars, houses, vacations, and other liabilities. So they do get poorer and poorer the more they borrow. They are also pinched by the effects of systemic debt like inflation and higher taxes.

Wealth-stealing force #3: Inflation

Back in 2011, I read an interesting stat in “The Wall Street Journal.” According to the International Monetary Fund, a 10 percent increase in global food prices equates to a 100 percent increase in government protests:

Despotic leaders, entrenched inequality and new forms of communication have all played a role in the political turmoil now shaking the Middle East. New research by economists at the International Monetary Fund points to another likely contributor: global food prices. Looking at food prices and instances of political unrest from 1970 through 2007, the economists find a significant relationship between the two in low-income countries, a group that includes Tunisia, Egypt, Sudan and Yemen. To be exact, a 10% increase in international food prices corresponds to 0.5 more anti-government protests over the following year in the low-income world, a twofold increase from the annual average. Given the recent trend in food prices, leaders of low-income countries, including China, might have reason for concern. In February, global food prices were up 61% from their most recent low in December 2008, according to the IMF.

In other words, when people are hungry, they’ll roast their leaders.

This is an interesting stat to me because I’ve been saying for years that inflation will cause global unrest. The reason for this is that when people are afraid for their lives, they will fight for them.

Of course, today we’re facing some of the highest inflation rates in the last forty years. And food prices today are threatening record highs. Ironically enough, they’re at their highest since 2011, when WSJ published the stat on the relationship between hunger and unrest. It remains to be seen what will happen now that food shortages from the Russia and Ukraine war are imperiling global food supply chains. Will more uprisings happen?

Domestically, inflation is stoked by the Federal Reserve and the US Treasury borrowing money or printing money to pay the government’s bills. That’s why inflation is often called the “silent tax”. Inflation makes the rich richer, but it makes the cost of living more expensive for the poor and the middle class. This is because those who print money receive the most benefit. They can purchase the goods and services they desire with the new money before it dilutes the existing money pool. They reap all the benefits and none of the consequences. All the while, the poor and the middle class watch as their buck gets stretched thinner and thinner.

The rich know they can borrow money cheaper today than tomorrow, invest in assets that cash flow, and let inflation reduce their debt cost.

The poor use debt to buy liabilities that depreciate over time while the cost of living goes up.

Which game would you rather be playing?

Wealth-stealing force #4: Retirement

In 1974, the US Congress passed the Employee Retirement Income Security Act (ERISA). This act forced Americans to invest in the stock market for their retirement through vehicles like the 401(k), which generally have high fees, high risk, and low returns. Before this, most Americans had a pension that their work provided. They could focus on their jobs and know they would be taken care of. After ERISA, Wall Street had control over the country’s retirement money, and most people had to blindly trust Wall Street because they simply didn’t have the education and knowledge to understand how to invest properly.

In a recent blog post, “Why 401(k)s and Mutual Funds Are the Path to Retirement Disaster,” I talked about how damaging 401k’s are to the average investor, especially in the age of high inflation:

In the world of stocks, many investors keep an eye on the Shiller PE index, a price earnings ratio based on average inflation-adjusted earnings from the previous 10 years. The median Shiller PE Ratio has historically been around 16 – 17. It’s a good barometer of what value we should be targeting. Again, a PE of 16 means that it costs us about $16 for every $1 of earnings we receive from that stock…

At this writing (March 7, 2022) the S&P 500 PE ratio is 34.38. One wonders how much higher it will go before investors decide to pull out into “safer” investments. When that happens, the poor suckers who blindly put their money into a 401(k) plan, will be left footing the metaphorical bill.

Today, we have a large portion of Americans with next-to-no retirement savings and an even larger portion in 401(k)s stuffed with mutual funds that could all go down together with another stock market crash like the one in 2000 and 2008. That is what you call the recipe for a retirement crisis.

It used to be that companies would take care of you for life. Now you have to take care of yourself, but most people simply aren’t prepared to do so. As such, they trust the “experts” to invest in paper assets through retirement plans like the 401k. All the while, those “experts” get richer by taking fees for every trade.

Businesses love it too because they don’t have to maintain a retirement fund, and they can pay you less in salary because they offer a “match”. Of course, they only have to pay the match if employees use the 401k, and many don’t.

But also, as I recently wrote in “401(k) Chaos: Why Your Retirement Plan Is Rigged Against You (And What to Do About It)”:

According to Steven Gandel, a study issued by the Center for Retirement Research indicates that, “All else being equal…workers at companies that contributed to their employees’ 401(k) accounts tended to have lower salaries than those at companies that gave no retirement contribution…In fact, for many employees, the salary dip was roughly equal to the size of their employer’s potential contribution.”

Translation, companies that don’t offer 401(k)s must pay a higher salary to compete with companies that do. Those company’s employees simply get their money as part of their salary rather than having to match it and save it in a tax-deferred retirement plan where they have no control and have high fees.

Again, this is how the rich use retirement to get richer while making you poorer.

The secrets of how the rich get richer

Here’s the kicker. The rich know how to use these forces to make more money rather than have them steal their wealth.

The rich know how to make investments and run businesses that allow them to pay little-to-no taxes.

The rich know how to use debt and other people’s money to make investments that provide constant cash flow while paying that debt off.

The rich know how to make investments that hedge against inflation and make them money while others are falling behind.

The rich know how to utilize all these forces to have a secure retirement provided by cash-flowing assets.

The rich can do all of this because they understand how money works and have a high financial IQ.

Learn how to play by the rules of the rich when it comes to money. It might not save the middle class…but it will save you.