When Robert Kiyosaki was a child, his poor dad – his natural father- told him “The best thing you can do with your money is save it.”

Rich dad, Robert’s best friend’s dad, thought that advice was hogwash. “Savers are losers,” he said. “If you want to be rich, you need to keep your money moving. The velocity of your money determines the size of your wealth.”

The poor mindset of saving money

In a post on the three steps to get rich in real estate investing, Robert shares a picture of a piggy bank and a savings register.

These are iconic images from our childhood, burned deep into our mind, about how to treat money. As the old adage goes, “A penny saved, is a penny earned.” Except when it’s not.

When rich dad said that savers are losers, it wasn’t an attack on them as people. There are many great people who follow the advice to save money. What he meant was they were literally going to lose in a world that rewards investors and is stacked against savers.

Here’s how he broke it down in his post:

There’s no doubt about it, from an early age we teach our children the value of saving money. “A penny saved; a penny earned,” we chime. And when they are a bit older, we spin tales of the magic of compounding interest. Save enough, children are told, and you’ll be a millionaire by the time you’re ready to retire.

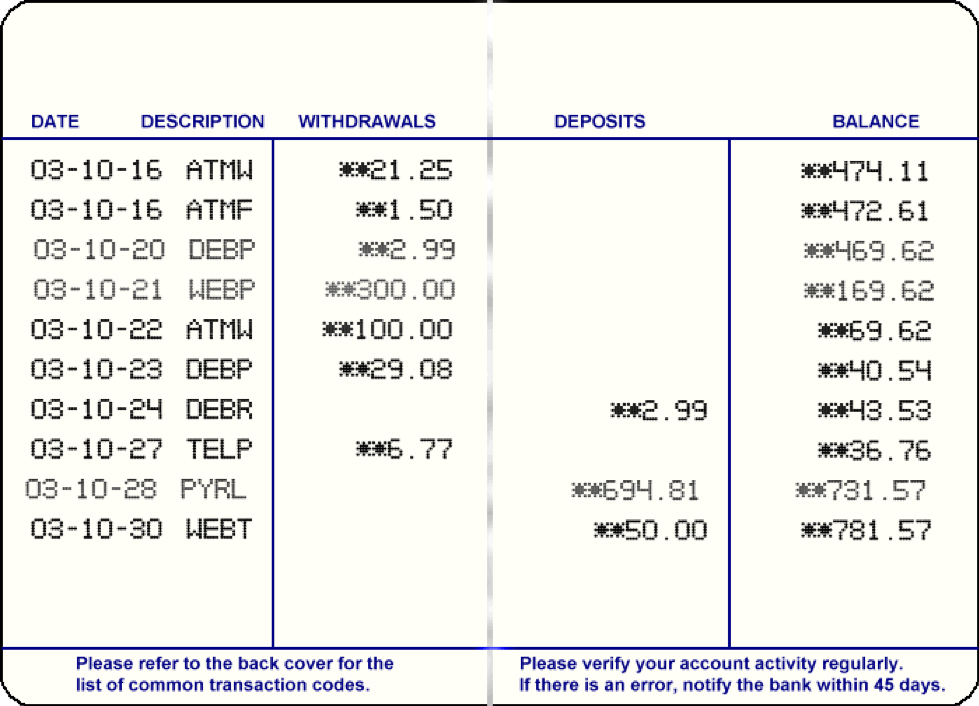

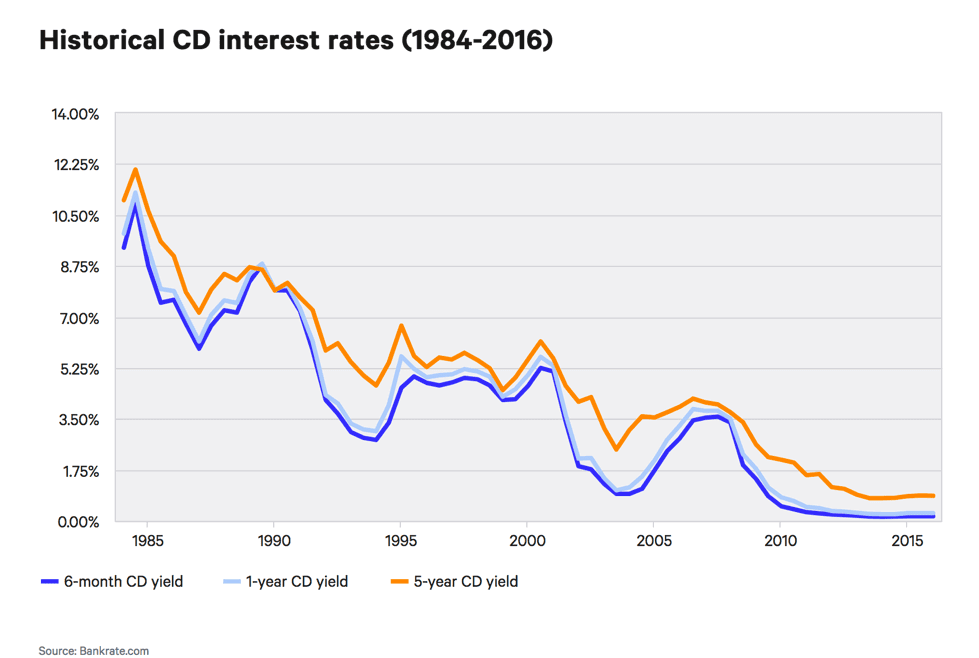

Of course, we don’t tell them about historically low interest rates.

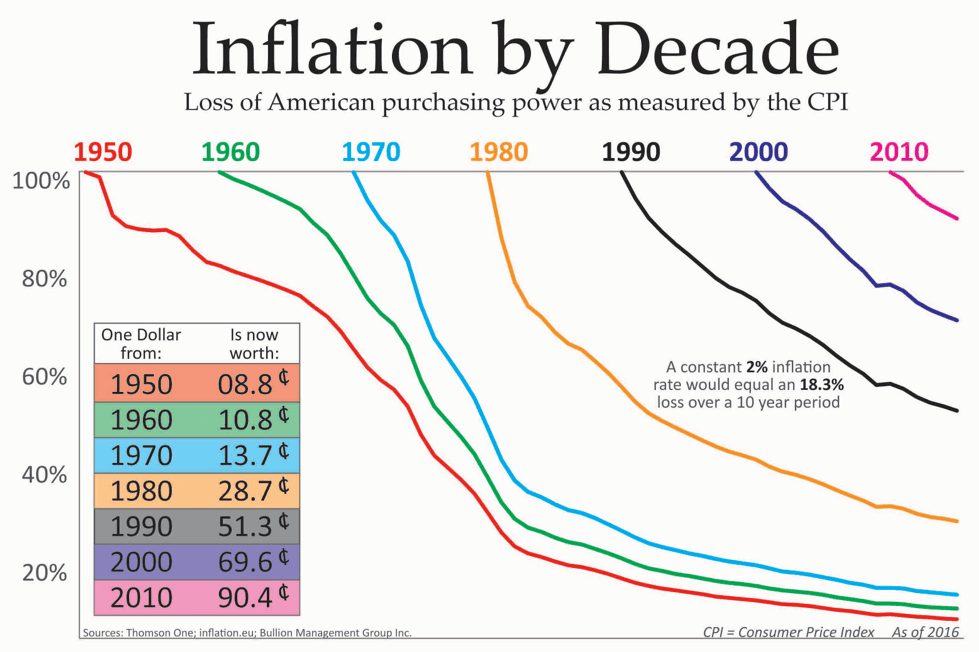

Or the power of inflation to eat away at the value of money over time so that being a millionaire is worthless by the time you retire.

Those are inconvenient financial truths.

It seems as if the “wisdom” to save your money is timeless, in that it won’t go away, even though it’s proven to be wrong. Even today you find “financial experts” who push the save to be a millionaire myth.

This is not what they teach you about money in school or at home. When poor dad said, “The best thing you can do with your money is save it,” he had no idea about what is in these simple charts. Robert’s poor dad was highly educated, had advanced degrees, and had a high-paying government job. But he didn’t know how money really worked.

When rich dad said, “The velocity of your money determines the size of your wealth,” he had these exact charts in mind. He never went to college, but he understood how money worked and how to make it work for him.

Error: Campaign not found.

The poor and middle class park their money

For the most part, the poor and the middle class follow the advice of poor dad and park their money, hoping it will grow over time and make them rich. It won’t.

The poor park their money by putting it in a savings account or even in a jar in their home. They get a paltry savings interest rate or nothing at all. Meanwhile, inflation eats away the value of the money, making them poorer over time. That is why they are losers.

The middle class save in different ways. They may have a savings account, but they also follow the advice of the so-called financial experts and park their money in 401ks, mutual funds, and other passive investment vehicles. The return may be slightly better than a savings account (if the stock market doesn’t crash!), but the principle is the same: keep your money parked, not moving, and hope you can get rich ahead of inflation and market swings.

The upper middle class makes bets with money

Robert wrote a post on John MacGregor’s book, “The Top 10 Reasons the Rich Go Broke: Powerful Stories that will Transform Your Financial Life…Forever.”

In that post, he shared the story of a young couple, Luke and Sue, whom John was advising on financial matters. Luke and Sue had a safe and modest investment strategy with John that would have allowed them to retire comfortably. They were high-paid employees and had been pretty conservative with their money. But then the 90s dot com boom hit and they wanted in. John told them it was a bad idea. The metrics weren’t good. It was basically gambling. But they put everything into tech stocks…and they lost everything.

People with lots of money but who don’t understand how money works are some of the most reckless people when it comes to money. They love to gamble under the guise of investing.

You see this with the obsession around flipping houses, buying the latest hot stock, or chasing down the latest get rich quick scheme.

The truth is sometimes the bet pays off, even handsomely. But it’s still a bet. They are moving money but in a haphazard way.

The rich move money in a very different way…by understanding there is a systematic formula to the velocity of money.

Velocity of money and playing with house money

To be clear, every investment has an element of gambling to it. The difference is that in both investing and gambling there are professionals and there are amateurs. An amateur doesn’t really understand the mechanics behind his or her bets. A professional knows exactly the right formula for increasing his or her chances to win…and win big.

In Las Vegas, professional gamblers move as quickly as they can to playing with house money.This means that once they have winnings from the modest amount of the money they’ve put into a game, they no longer use their own money to bet and only use the casino’s money, their winnings. They want to move as quickly as possible to using other people’s money, or OPM.

Professional investors play the same game. As quickly as possible, they want to get their money out of an investment and use the income from that investment to make their money work for them.

The definition of velocity of money

When talking about money, Think of an electrical current. Electric currents are a powerful force, but they have one weakness, they must continue to move. If an electric current stops, it dies.

As such, money works the same way. Outlined above with interest rates and inflation, money that is saved, or parked, dies over time. Money must move into new places in order to survive and grow.

And that is the definition of velocity of money. A professional investor understands that they need to continually move their money into new assets in order to keep it alive. What is more, they understand that it’s not enough to invest money in assets, but they need cash flow from those investments so that they can move the “house money” into other assets. By doing this, they create exponential growth in their wealth.

Remember this fundamental rule: to be an investor, you need to receive money…and invest it forward.

The formula to find the velocity of money

How do you find the velocity of money? Good news! There is a simple formula. But beware, this is not a get rich quick scheme. Learning this formula is one thing. Applying it and building wealth over time is another.

Here’s the formula:

- Invest my money into an asset

Saving is not bad…if it has an end goal. And that goal should be to invest it. Again, if you save money but don’t invest it—that is, move it—it will die.

- Get my money back

Rich dad said, “In order to be an investor, you need to receive money.” You might invest in assets, but if those assets aren’t paying you back in cash flow, then you’re not really an investor. You’re a speculator hoping your assets grow in value.Robert and his real estate advisor, Ken McElroy have applied this portion of the formula many times over, putting money into apartment investments, doing improvements and raising rents, and then refinancing the apartment loan to get their money back. - Keep control of the asset

A major component of the velocity of money is that it grows exponentially over time…much more so that compounding interest. How? By keeping your assets that still give you cash flow, while also using the money from those assets to acquire more assets.When Robert and Ken refinance an apartment building, they get their money back tax-free, keep the apartment building, and continue collecting cash flow from that apartment building.You can do this with any cash-flowing asset such as a business or venture capital. - Move my money into a new asset

This is the velocity part of the velocity of money. Once you get your money back from the original asset, you don’t sit on it. You move it into another asset! Robert and Ken take the money they get from their refinance of apartment buildings and move that capital into yet another great apartment investment. Now, they have two great, cash-flowing assets and they’re playing with house money. - Repeat the process

Simple enough to understand. This is a repeatable formula you can employ over and over again to build massive wealth. This is how the rich get richer.

Two major benefits of the velocity of money formula

If you want to be rich, there’s no better formula to put into practice than the velocity of money, and it comes with two major benefits.

- It significantly reduces your risk

Professional gamblers know that once they are playing with house money, there’s really nothing to lose. They still possess their money and now they can get creative.Professional investors who get their money back and then use cash flow from their investments to make further investments understand the same thing. When you’re playing with cash flow to build wealth, you reduce the risk to your own money. Made a bad investment? That’s OK. Learn and draw from your other good investments to make another one. No harm; no foul. - It allows you to compound income at a faster pace

Hopefully this is self-apparent now that you’ve read this far, but the velocity of money will grow your wealth exponentially faster than saving it and counting on interest and appreciation. Like a flywheel, it starts out slow but once the momentum gets going, you compound your income at an amazing pace. This is why billionaires like Bill Gates can’t spend or give their money away fast enough. Even if they tried to give everything away, the velocity of their money is so fast that they can’t get ahead of it.

Error: Campaign not found.

Get into the velocity of money game

Ok, now’s the part where you get into the game. Take some time today to figure out how you can move from parking your money to getting it moving. If you want to really get into the mindset of the rich when it comes to velocity of money, play a free game of CASHFLOW Class online. Besides actually doing something, simulating is the best way to learn. CASHFLOW will allow you to flex your professional investing muscle without putting your own money on the line, so you’ll have more confidence when you’re ready to jump into the real-life game of investing.