Blog | Personal development, Personal Finance

Who Are You Making Rich?

June 17, 2014

Seeing the whole picture to becoming a successful investor

Last week, I wrote about the importance of taking control of your cash flow by understanding how a financial statement works.

This week, I want to talk about why moving beyond your own financial statement is the key to seeing the whole picture of what it takes to be a successful investor.

It takes two

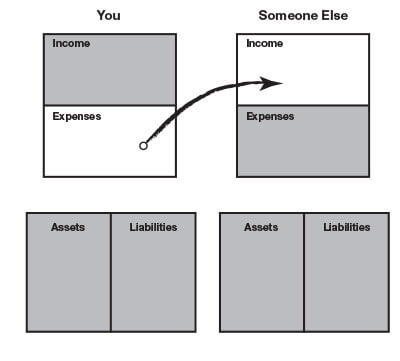

Rich dad said, “Sophisticated investors must see at least two financial statements simultaneously if they want a true picture.” He drew the following diagrams:

“Always remember that your expense is someone else’s income,” said rich dad. “People who are out of control of their cash flow make the people who are in control of their cash flow rich.”

What investors do

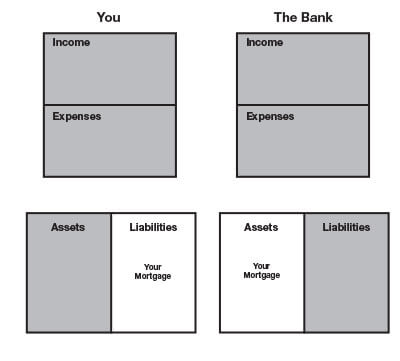

Rich dad then drew up an example of what an investor sees using the example of a homeowner and a bank.

For the first time, I was seeing a true financial statement, the whole cycle of cash flow. What I noticed after some studying was that the same mortgage appeared in two different columns, the asset column and the liability column.

The lesson was that each person’s expenses are someone else’s income, and each person’s liabilities are someone else’s assets.

“That is why people who leave school and have not been trained to think in terms of financial statements often fall prey to those who do,” said rich dad. “When your banker says your home is an asset, they’re not really lying to you. They’re just not saying whose asset it really is. Your mortgage is your liability and the bank’s asset.”

Out one pocket and into the other

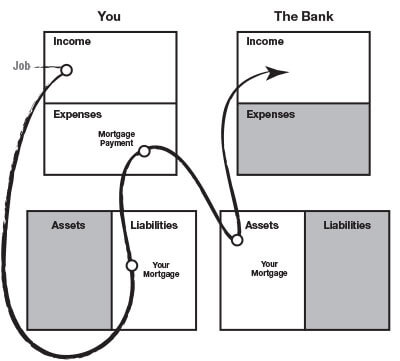

Rich dad’s simple definition of an asset was something that puts money in your pocket. His simple definition of a liability was something that takes money out of your pocket.

To demonstrate why a house was the bank’s asset, not the homeowner’s, he drew this diagram:

What good investors do is acquire or create assets that someone else pays for. If you can be on the cash-in-your-pocket end of the equation more than on the cash-out-of-your-pocket side, you’ll be a successful investor.

Learn by doing

Becoming a successful investor takes financial education and it takes putting that education into practice. One way to practice is to play games that simulate reality. The lessons are learned with less risk. That’s why I created CASHFLOW, a game that teaches the basics of financial literacy, accounting, and investing. Play for FREE online.

Today, I encourage you to start learning by doing. Take a look at your financial picture. Where is your cash flow going? Who are you making rich? Understanding this can make all the difference.

Original publish date:

June 17, 2014