Blog | Personal Finance

What is Investing for Passive Income? (And Why is it Important!?)

If you’re planning on investing, there is only one way you should do it. The Rich Dad way is to invest for passive income

Rich Dad Personal Finance Team

July 20, 2023

Summary

-

Investing for passive income is the most promising way to become truly rich

-

Understanding how to generate passive income requires a strong financial intelligence

-

There are several investment categories to generate consistent passive income.

It’s during hard economic times that you can really tell the difference between two vastly different types of investors.

For example, you may have a conversation with someone seemingly successful who finds themselves financially struggling, and saying things like “It’s rough out there, my 401k is taking a beating.”

On the contrary, a successful investor who has a different experience might say “I’m doing great! Cash keeps coming in.”

What was the difference between these two investors? The best way to answer that question is by first exploring three different types of cash flow patterns.

The three different types of cash flow patterns

In the article, Your Cash Flow Patterns Determine How Rich You Will Be, you’ll find robust definitions about the three different types of cash flow patterns; but it will be helpful to review them here as well.

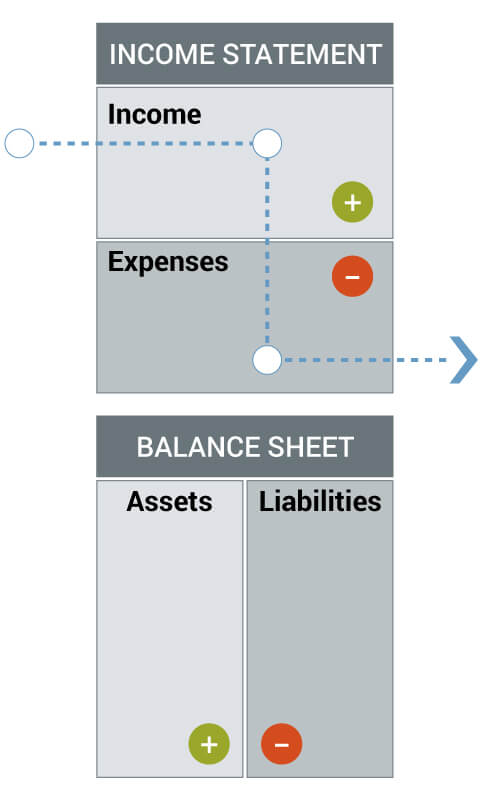

The cash flow pattern of the poor

The poor are often known to lament that they live paycheck to paycheck. And they’re not wrong. Most poor people have a cash flow pattern that looks like the one below. Income comes in the form of a paycheck and promptly goes out to various expenses.

If they’re lucky, they can cover their expenses each month. If not, they take on debt, often in the form of credit card debt, which only makes them poorer and increases their monthly expenses. The only way they can get ahead is to get a higher paying job or another job…just to make ends meet. It’s a very sad way to live.

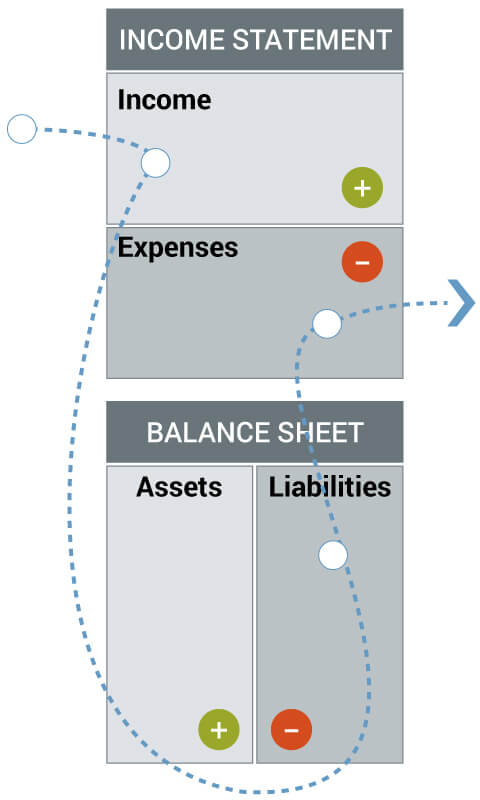

The cash flow pattern of the middle class

The poor aren’t the only ones who live paycheck to paycheck. Below is the cash flow pattern of the middle class.

The middle class can often seem rich to the outsider looking in. They might have big salaries, fancy houses, nice cars, and more. But what they really are is just living the Rat Race. Instead of putting their money straight to expenses to live, like the poor, they buy liabilities like vacations, houses, and luxury cars, which then means their money goes from there out the expense column. They might also put some money in 410k, but as you’ll see later, that also is a liability, not an asset.

The interesting pattern for the middle class is that as they get more liabilities, their taste grows and they want more. So they get a higher paying job and then buy more liabilities. But here’s the scary part, if they lose their job, they can’t cover their expenses. Why? They don’t have any income outside of their salary, and they often have large liabilities and expenses. If they’re lucky they can get a new job before it catches up to them. If not, they declare bankruptcy.

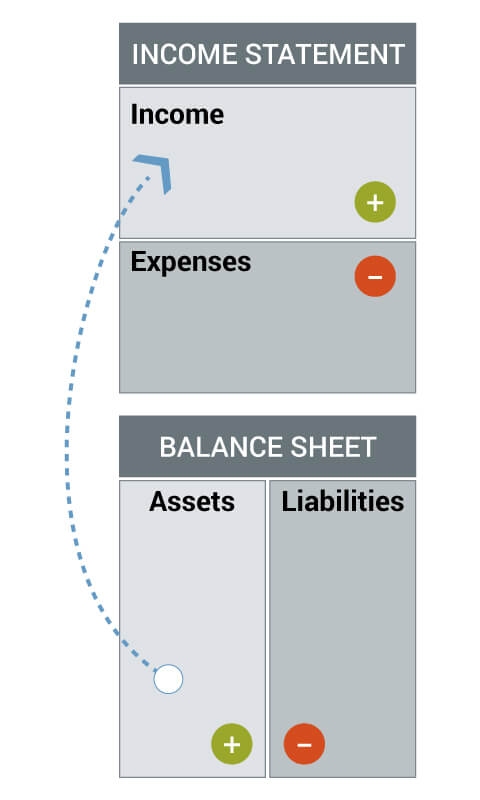

The cash flow pattern of the rich

The rich have a vastly different cash flow pattern than the poor and the middle class. It looks like this:

Very simply, the truly rich obtain their income from their investments in the form of cash flow. They then use this income to buy liabilities and pay their expenses. They don’t rely on a job or a salary to do this. The money comes in each month in the form of passive income.

The difference between earned and passive income

The biggest difference between the people we encountered earlier, is that of earned vs. passive income, which is really at the core a mindset difference.

Let’s start by looking at the CASHFLOW Quadrant.

E is for employee

Employees value security and look for a great job and salary.

S is for self-employed

The self-employed value freedom and independence, but they don’t play well with others. They are the best at what they do, so they don’t trust others. They don’t own a business, but they own a job. If they don’t work, they don’t earn. So while they have freedom in the sense that they are their own boss, they aren’t really free because they still have to work.

B is for business owner

Business owners value independence and freedom as well, but they obtain it by building a system and a team. They don’t have to work to earn, because their business makes the money.

I is for investor

Investors are the smartest financially of those in the CASHFLOW Quadrant. They use their money to make money by investing in assets that produce cash flow each month.

The difference between those on the left and right side of the quadrant is that of mindset and cash flow. Es and Ss are concerned with security, so they work for earned income, that is income others generate and then pay them for their efforts. Essentially they sell time.

Bs and Is are concerned with true freedom. They build businesses and make investments that provide passive income to cover their expenses. If they don’t want to, they never have to work another day in their life.

Two types of investing: capital gains vs. passive income

Those on the left side of the CASHFLOW Quadrant can sometimes think of themselves as investors; for instance, someone who shudders at the thought of their 401k performing poorly. In reality, they’re not an investor, but rather a gambler.

That’s not to say Es and Ss aren’t smart. Often, they have high intelligence, just not financially.

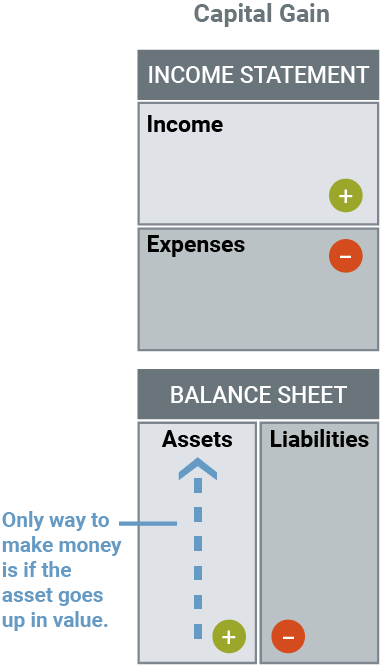

For instance, if they put their money into a 401k, they’re at the mercy of it going up and down each month. Even worse, it’s actually a liability because it takes money out of their pocket each month and doesn’t put any money in. It could be an asset, but only if earnings are collected. Until then, it’s a liability. Here’s what that investing pattern looks like:

This is investing for what is known as capital gains. Es and Ss who bank on a 401k are hoping the price will go up and that they can sell to make money in the end. It’s a gamble but like all bets, it can pay off. Unfortunately, it also is the highest taxed investment.

On the right side of the CASHFLOW Quadrant, where folks invest for passive income, a.k.a, cash flow, you can find people who invest in things like real estate. For example, they earn rent from their properties each month, enjoy great tax benefits, and have only a small amount of their own money in their deals. And when the market goes south, they only see opportunity because these types of assets go on sale.

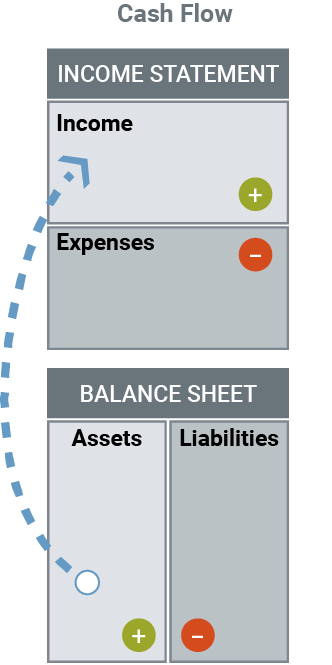

Because these investments are for passive income, assets cover expenses each month. This is true freedom. Here’s what that investing pattern looks like:

Types of passive income investing

Hopefully you’ve learned enough to know that investing for passive income is vastly superior to any other type of income. To finish out this post, take a look at the different approaches to investing for passive income to get your mind going. Our advice is to see what interests you most and then do a deep dive to learn all that you can about it.

Real estate

It’s already been mentioned on this post, but real estate is highly favored by Rich Dad (in fact, it’s Robert Kiyosaki’s favorite investment category for passive income). In real estate, your passive income is made up of rents. Simply put, if your rent covers your expenses, you will have passive income. The more investments you have or the larger they are, the higher your passive income. Additionally, there are great tax benefits and the ability to use OPM (Other People’s Money) to easily get into real estate.

Stocks

While at Rich Dad we don’t like stocks as capital gains investments, we do find them valuable for passive income. Two types of investments you can make in stocks for cash flow are dividends and the covered call strategy. If you want to learn more about these, read this in-depth post, “Investing for Cash Flow With Stocks.”

Business

You do not have to be a business owner to enjoy the benefits of the B quadrant. A great way to create passive income is to invest in other people’s businesses. As an investor, you can have control, often in the form of a board seat, and help steer the course of a business to great profitability. Unlike a business owner, you don’t have to manage the day to day or be responsible for the operating aspects of the business. You simply enjoy the profits in exchange for your capital.

Start investing for passive income today

While investing for passive income is a great strategy, it does take financial intelligence. Start by learning everything you can about the investments you’re most interested in. Also, learn everything you can about money. Take classes, hire a coach, and consume as much free education as you can. There’s so much out there in terms of resources. More than ever in human history. All you have to do is take advantage of it, and then make your move.

Original publish date:

July 11, 2022