Blog | Entrepreneurship

Will A High Paying Job Provide Financial Security?

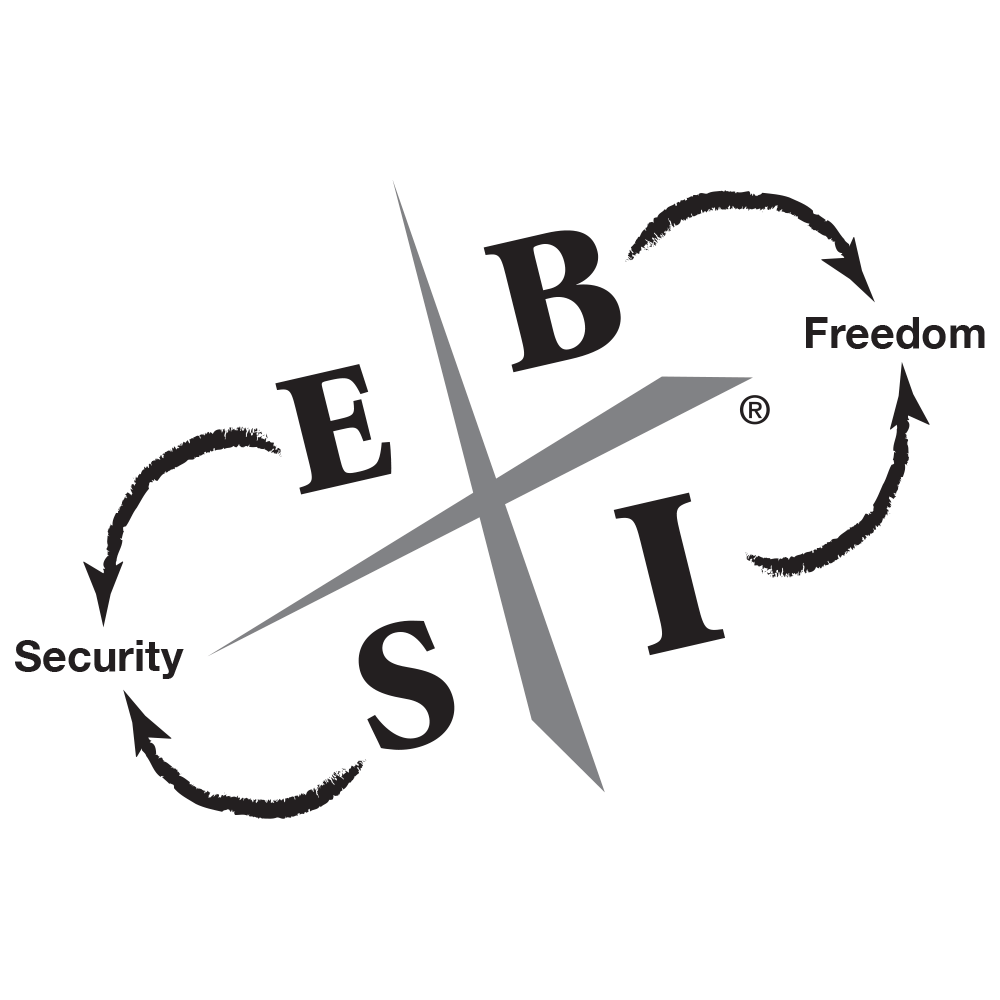

Why operating from the left side of the CASHFLOW® Quadrant is not the path to financial security

Rich Dad Entrepreneur Team

February 28, 2023

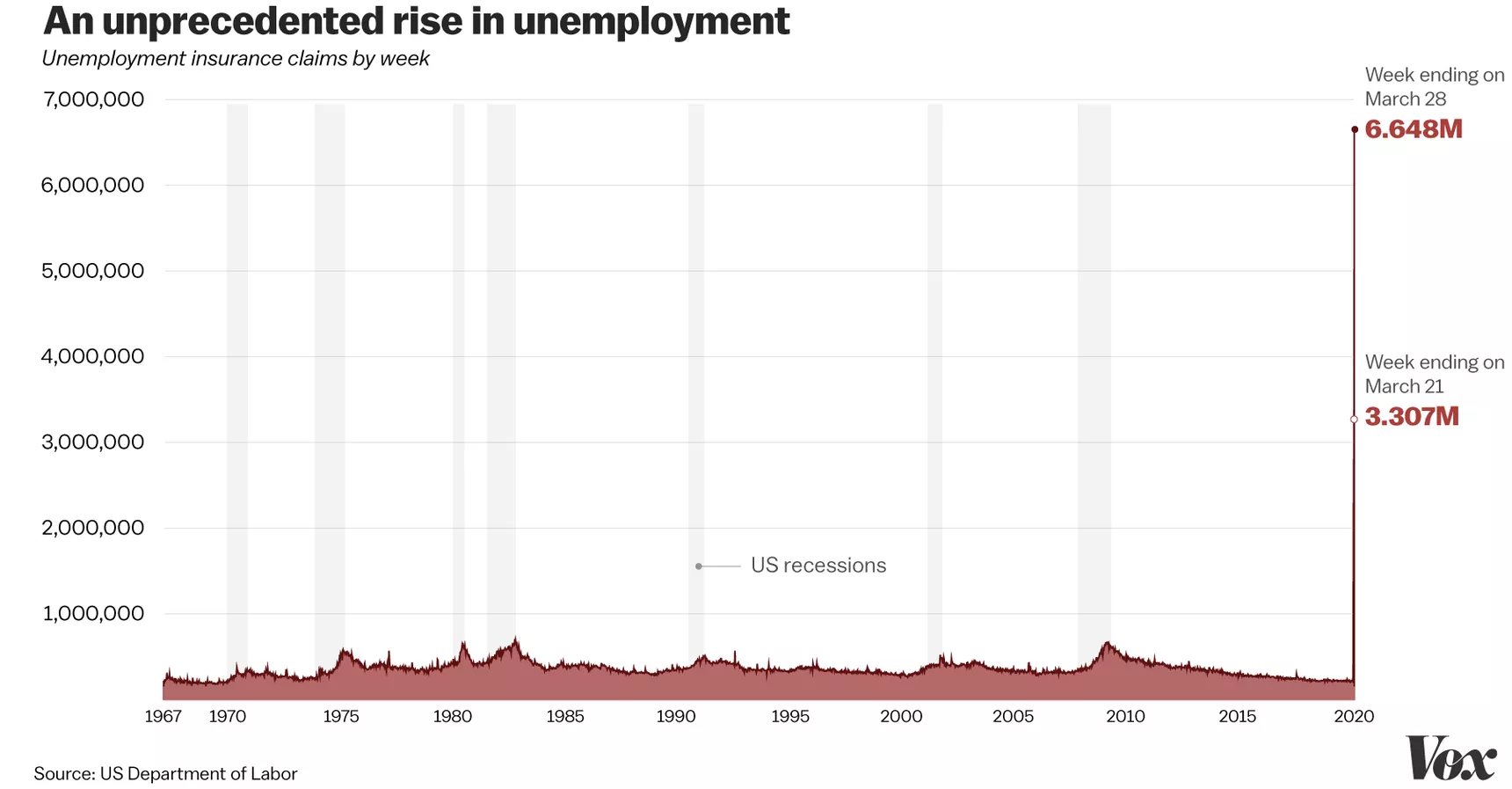

Take a look at the Vox chart below, which highlights the 2020 surge of unemployment in the United States. It’s just one of the truest depictions of the dangers of being an employee.

As the Coronavirus swept across the nation, millions of people filed for unemployment in an effort to keep afloat. As you can see by looking at the far right side of the graph, there is no precedent for this. Not the Great Depression. Not the Great Recession. Nothing.

As a result, the economy now looks fundamentally different, along with how companies operate regarding spending and employees.

One employee who was lucky enough to still have a high-paying job (though, not feeling secure, necessarily), discussed how his employer cut millions out of their existing budget and did a hiring freeze; when their company - like others throughout the country - went completely remote, he said “You know what? We’re more productive now than ever before.”

Don’t think his CEO isn’t noticing how much bloat they had unknowingly been carrying over the years. The Covid crisis exposed it; and as a result, those jobs and contracts won’t be back.

Good jobs are outsourced to contractors, robots, and automation

“Never before have American companies tried so hard to employ so few people.”

So goes the opening shot for a 2017 article published in the “Wall Street Journal” called “The End of Employees."

The article details how many of the major companies in America are doing their best to outsource their jobs to contractors, or automate them, rather than hire employees. The percentage of the American workforce that is not directly tied to a company has risen by almost 100% by some estimates, and it shows no sign of stopping. “Steven Berkenfeld, an investment banker who has spent his career evaluating corporate strategies, says companies of all shapes and sizes are increasingly thinking: ‘Can I automate it? If not, can I outsource it? If not, can I give it to an independent contractor or freelancer?’”

“Few companies, workplace consultants or economists expect the outsourcing trend to reverse. Moving noncore jobs out of a company allows it to devote more time and energy to the things it does best. When an outside firm is in charge of labor, it assumes the day-to-day grind of scheduling, hiring and firing. Workers are quickly replaced if needed, and the company worries only about the final product.”

The article continues that, “Eventually, some large companies could be pruned of all but the most essential employees. Consulting firm Accenture PLC predicted last year that one of the 2,000 largest companies in the world will have ‘no full-time employees outside of the C-suite’ within 10 years.”

Does job security = financial security?

When Robert Kiyosaki was a child, his poor dad, his natural father, wanted nothing more for him than to go to a good school, get his degree, and get a good, safe, secure, high-paying job. This is not unlike how most people were raised—and how most people have lived their life. For the majority of people, job security through a high-paying job is priority number one.

Rich dad, Robert’s best friend’s father, taught him how to think like an entrepreneur. He didn’t want him to grow up to be an employee. He wanted him to grow up and be a business owner and investor.

For poor dad, a job was the ultimate sign of financial security. For rich dad, being an employee was risky.

Rich dad was well-ahead of his time. To be an employee is an illusion of security. You have a steady paycheck, but you are not in control. You are at the mercy of the business owner and the economy. If either decide you are not needed, you lose your job—and if you’re really unlucky, lots of other things like your house, your car, and more. And now, unfortunately and clearly, it is riskier than ever to be an employee.

This shouldn’t come as a surprise, and many people who have been laid off, fired or furloughed have simply said, “I’m not surprised. I’m just sad.”

But it’s still not too late to make a change. Because the other side of this crisis could be a gold mine for those with the right mindset.

Contractors, automation, and robots, oh my!

In the Wizard of Oz, Dorothy and her motley crew of fellow travelers are in the dark and foreboding woods. They sing, “Lions and tigers and bears, oh my!

Today, many people are in the dark and foreboding woods financially. They are not afraid of natural predators like lions and tigers and bears, but they are afraid of a new kind of predator: contractors, automation, and robots.

Whether it is from robots and automation, many jobs are being outsourced to technology. And if jobs are not taken by technology, they are now taken by contractors. Just look at how companies like Lyft and Uber are disrupting the taxi industry, how Airbnb is disrupting the hotel industry, and how driverless cars will disrupt industries like shipping.

The dangers of the gig-economy and owning a job

Many view the rise of contractors and the so-called gig economy as a good thing, but it is not. The argument goes that we are finally creating entrepreneurial opportunities for the masses. Entrepreneurship has been democratized, so they say.

The reality is that most people participating in the gig economy are not entrepreneurs.

Rather, they simply own a job. They still operate on the left side of the CASHFLOW Quadrant, just as a self-employed person rather than an employee.

This owning of a job is a great advantage for companies who no longer have to pay payroll taxes, provide health insurance, or fund retirement plans. They get all the labor and none of the trappings. And it’s all packaged in the allure of freedom.

Unfortunately, gig workers are not financially free. They work long and hard hours to make less and have less benefits than employees did historically. If they cannot put in the hours, they do not make the money. That is not how an entrepreneur operates. An entrepreneur makes money even when he or she is not working.

Of course, anyone looking for a good job or doing all they can to hustle in the gig economy is really looking for one thing… to be financially free. Unfortunately, they will not find financial freedom in either sector.

Why job security doesn’t guarantee financial security

The path to true financial security or freedom is found on the right-hand side of the CASHFLOW Quadrant—the Business (B) and Investor (I) side. Unfortunately, most people look to the left side of the CASHFLOW Quadrant for security—the Employee (E) and Self-Employed (S) side.

Poor dad was highly educated. He was also fixated on job security. The most important thing to him was having a good, high-paying job. It was a value most of his generation shared, and one that he instilled into his kids from a young age. He assumed that job security meant financial security—that is until he lost his job and couldn't find another.

On the other hand, rich dad never talked about job security. Instead, he always talked about financial freedom. He showed Robert the patterns for different kinds of security and freedom found in the CASHFLOW Quadrant.

The pattern for job security

People who follow this pattern are good at their jobs. They are highly educated and have a lot of experience. The problem is they know little-to-nothing about the B and I quadrants. They feel financially insecure because they have only trained for a job and rely on others for their living.

Often, people in this pattern will put money into a retirement account. But even then, they still feel insecure because they don't actually know what is happening with their money. They hope the manager of the account will do a good job. But, for the most part, it's money that just disappears from their paycheck each month. And when they get their retirement statement each quarter, they don't know how to read it.

In order for those in the pattern of job security to feel financially secure, they must increase their financial education and learn how to invest.

The pattern for financial security

This is the pattern for financial security for an E:

Instead of putting money into a retirement account and hoping for the best, this loop is for people who feel confident in their education as both an investor and an employee. Study to become a professional investor just as you study at school to learn a job.

This image shows the pattern for financial security for an S:

The average American millionaire is self-employed, lives frugally, and invests for the long term. The pattern above reflects that financial life path.

Additionally, both E's and S's can move into the B side of the quadrant. For instance, great entrepreneurs like Steve Jobs took that route. It's not the easiest but, it's one of the best.

The pattern to be financially free

Most people are concerned with financial security, and there's nothing wrong with that. But even better than being secure, is being financially free. That’s what happens when one lives and breathes entirely on the right-hand side of the CASHFLOW Quadrant.

The following is the pattern for financial security:

This is the pattern recommended by rich dad, but it is not for everyone. It is, however, the pattern for true financial freedom because in the B quadrant people are working for you and in the I quadrant your money is working for you. You are free to work, or not. If you look at the ultra-rich, this is their pattern.

Choose your path to financial security

Today, you can choose which financial path you want to take. Will it be job security? Financial security? Or Financial freedom?

Unfortunately, most people choose job security, especially in tough economic times. But when you realize that you’re relying entirely on someone else for your livelihood, how secure is it, really? And in times of economic trouble and technological disruption, jobs come and go. As the “Wall Street Journal” points out, companies are doing their best to eliminate job security in the future. And as our recent history shows, millions upon millions of jobs can disappear in the blink of an eye.

At a minimum, it’s important to become educated in financial security, which is feeling confident about your job and also confident about your ability to invest in both good and bad times.

But, if you have it in you, the best path, and one of the hardest, is choosing financial freedom. It takes a high level of financial education to succeed in the B and I quadrants. It also takes a lot of passion, commitment, and vision. But the payoff is worth it.

Original publish date:

August 06, 2013