A cultural right of passage is buying your own home. Many people dream of the day when they get the keys to their own front door, imagining the joy that will come with the monumental achievement of taking on hundreds of thousands of dollars in personal debt.

Of course, this is all said in jest.

However, it seems like every financial “expert” says, “Your house is your biggest asset.”

When Robert Kiyosaki wrote Rich Dad Poor Dad, he said that your house is not an asset. Rather, it’s a liability. That was like spraying water on a hornets’ nest. The so-called experts lambasted me. At the time, the real estate market was skyrocketing. Everyone called him a contrarian who was out to sell books. Then, one of the worst housing crashes in US history happened, and they weren’t laughing anymore.

Our recent series of articles, called Rich Dad Scams, uncover the lies that are fed to people by the rich to keep them poor and in the middle class. Today, you’ll read about one of the biggest Rich Dad Scams of all: “Your house is an asset.”

Is a house an asset?

The reality is that many people desire to buy a home because they think of it as a good investment. In terms of a financial statement, they think of their house as an asset. Because of this, in many cases, homeowners expect their house to be a big part of their retirement plan.

In 2019, for instance, Rob Carrick wrote for the Canadian “The Globe and Mail”:

“In a recent study commissioned by the Investor Office of the Ontario Securities Commission, retirement-related issues topped the list of financial concerns of Ontario residents who were 45 and older. Three-quarters of the 1,516 people in the survey own their own home. Within this group, 37 per cent said they are counting on increases in the value of their home to provide for their retirement.”

Error: Campaign not found.

This is a sentiment that is likely the same here in the US, and in many places throughout the world.

The problem with this thinking is that many people simply do not know the difference between an asset and a liability.

Why a house is not an asset

Your financial planner, real estate agent, and accountant all call your house an asset.

In reality, an asset is only something that puts money in your pocket. So-called financial experts have lots of fancy accounting maneuvers to make things that aren’t assets look like assets, and they can be helpful for certain situations.

But in the real world where you need money in your pocket to survive, if you have a house, paid for or not, that you live in, then it really isn’t an asset. Instead of putting money in your pocket, it takes money out of your pocket in the form of a mortgage, utility payments, taxes, maintenance, and more. That is the simple definition of a liability.

This is doubly true if you don’t own your home yet. Then it’s the bank’s asset, and it is working for them. Each month you pay the bank interest on top of the equity you pay into the house in the form of your mortgage. If you look at an amortization table for your house, you can see plainly that the house is the bank’s asset because it makes a huge return in the form of cash payments month after month. If you default, they keep the house and the money you’ve already paid them. It’s earning the bank a lot of money, but it’s not earning you anything.

Many so-called experts will point to things like paying down principle, tax breaks from mortgage interest, and appreciation as reasons why the house is an asset, but paying down principle is simply saving and savers are losers, the tax breaks for your mortgage do not offset the costs that go out of your pocket each month, and if you’re banking on appreciation, you’re basically gambling, as homeowners in the Great Recession painfully discovered.

This is not to say you shouldn’t buy a house. It’s just important to understand that it isn’t an asset. Rather it is your home, and should be enjoyed for that, not as your ticket to a secure retirement. Look elsewhere for that. Truth sets people free, and the truth that your home is not an asset but instead a liability, is one of the most important truths you can know.

But people make money off a house all the time, right?

Sure, you can make money from a house. There are lots of ways to do this, and I’ll describe how investors do it later. But often when people say you can make money off your house, they mean their personal residence. This is true. Some people do make money from their homes, and when they do, it can then become an asset.

The way most people make money is from selling a house after years of living in it. This is what you call realizing equity. The difference between what you bought your house at and what you can sell it for is appreciation. Oftentimes you pay a lot of equity down over many years. This coupled with a modest gain in appreciation can feel like a true windfall. But it is often a small return on the money you put into the house.

Error: Campaign not found.

Worse yet, many people realized that appreciation is not guaranteed in the great recession. They lost everything as the price of their house dropped well below what they paid it for. Then the house was a real liability.

The reality is that while you live in your own home it cannot be an asset. If you’re lucky and you decide to sell, it can be, but that is truly a gamble. Until you decide to sell, your house takes money from you month after month, even if it’s paid off.

So, how can a house be an asset?

In business terms, assets are your pros and liabilities are your cons. You need assets to offset your liabilities. Most people spend their lives earning money at a job and spending it on liabilities, even ones they think are assets like houses.

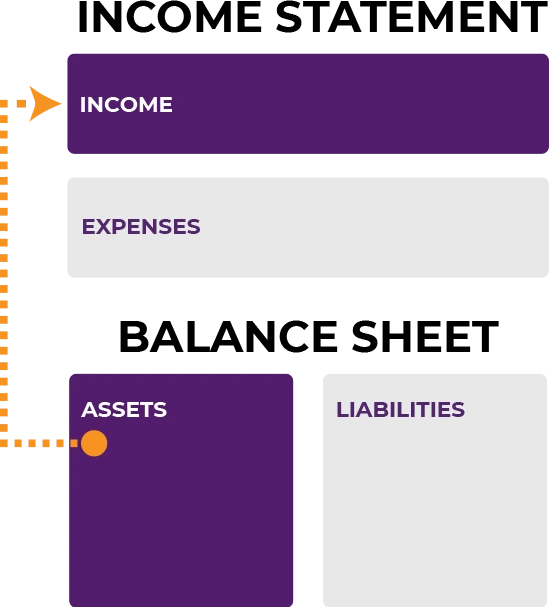

This is easier to comprehend if you understand how your personal financial statement works. Here are two illustrations that make things simple:

This first chart shows the flow of cash from an asset into your income column. Again, what makes something an asset is that it puts money in your pocket each month.

This gets complicated by so-called experts because they’ll often list a liability in an asset column, like your home.

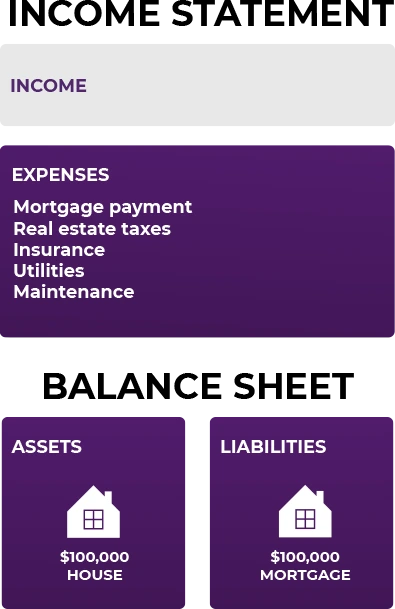

Here we see a $100,000 home is listed as an asset but there is no cash flowing into the income column. Additionally, there is a liability of the housing expenses and the $80,000 mortgage.

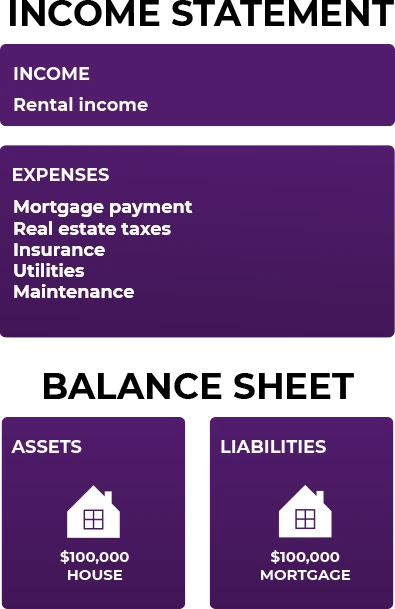

Now the minute you start to realize income from a house, it can then become an asset.

The caveat is that the income from the house needs to be higher than the expenses. It needs to have positive cash flow. This, of course, only happens with investment property. The renter pays you rent that covers your expenses, including your mortgage and your taxes. You make money each and every month while they also pay down your liability. It’s a wonderful thing.

Once you get away from the Rich Dad Scams, it’s easier to think in these terms, to think like an entrepreneur. Assets put money in your pocket. This is accomplished through five different categories, one of which is real estate.

Real estate doesn’t mean your personal residence (a liability); what it actually means is what is described above, investment real estate, which is a great investment because it puts money in your pocket each month in the form of rent.

There are four other primary assets: business, paper, commodities and cryptocurrency. If you are an entrepreneur or a business owner, your business is an asset. Paper assets are stocks, bonds, mutual funds, and so on. Commodities include gold, and other resources like oil and gas, and so on. Finally, cryptocurrency is a digital currency that is maintained by a decentralized system.

Robert Kiyosaki started making his money in real estate, putting their money to work in properties that they could rent out and see ongoing returns. After that, they diversified, and now have money in all five asset classes.

Invest for cash flow, not appreciation

The Rich Dad Scam that your home is an asset was prevalent when Robert first wrote “Rich Dad Poor Dad.” That was in 1997, and everyone’s home values were climbing. It was easy to assume that your house was an asset because it was potentially making money for you in the long run through appreciation. People bought into the scam hook, line, and sinker, taking out home equity loans to buy cars, vacations, TV’s, and more.

During the Great Recession, those same people were so underwater that many of them defaulted and went into foreclosure. They gambled on appreciation, and it didn’t pay off. A lot of Americans got a fast, ugly financial education when the real estate market turned around. They realized very quickly that their homes were not assets.

Error: Campaign not found.

Today, the housing market is again relatively healthy and a lot of people are starting forget the lessons from the Great Recession, so it’s more important than ever to reeducate them on the fact that their house is not an asset, what an asset really is, and how to tell the difference between an asset and a liability.

The difference between Robert’s poor dad (his natural father) and his rich dad (his best friend’s father) was financial education. And that’s not a classroom and books education, that’s a nuts-and-bolts, street-smart education, a way of looking at money that is true and that works, not just what the rich want you to believe.

Rather than invest for appreciation, rich dad taught to invest for cash flow and to treat appreciation like icing on a cake. And you should do the same.