Blog | Personal Finance

Add CASHFLOW to Family Game Night

Playing CASHFLOW® the Board Game, teaches skills kids won’t learn in school

Rich Dad Personal Finance Team

June 19, 2025

summary

-

Families can boost financial IQ together through play.

-

Learning about money should be fun, hands-on, and memorable.

-

Contrary to popular belief, humans learn best by DOING.

Take a moment and think about how you learned about the concept of money. Perhaps it was from emulating your parents, receiving an allowance, earning your first paycheck, getting your first apartment, a family game night with Monopoly, or by racking up a ton of debt on your credit cards. Regardless of which scenario rings true, It’s likely none of you learned about money in school. Isn’t that scary?

Schools teach science, math, grammar and history — but according to the biennial Survey of the States by the Council for Economic Education, they aren’t doing enough to provide a financial education that will help prepare students for adulthood. And even if they did teach it, I’d venture to guess it would be taught with a boring book and corresponding lectures — which aren't the most effective ways to learn.

Millennial's Money

Below are some shocking (yet unsurprising) statistics about millennials (Americans ages 23-38) and money:

- 66% of people feel they would be more financially secure today who had they received financial literacy education as children

- 86% of millennials admit they spend more money per month than they should

- 55% of millennials are living paycheck to paycheck

- 70% say they want to do more investing, but the process intimidates them

According to Jerry J. O’Flanagan, executive vice president, Consumer Banking Group, First National Bank of Omaha: “Millennials are facing a unique set of financial circumstances and challenges, as well as opportunities — from college debt to rising healthcare costs to the availability of new tools and technologies. For Millennials, and those of any generation, the solution for a healthy financial future starts with education — which is then followed by planning and discipline. The younger a person starts learning about money, the better the outlook for their long-term financial health.”

This is something Robert and Kim Kiyosaki have been preaching for decades. It’s too bad our nation’s school systems haven’t made a dent in addressing the lack of financial education for its students, a problem that is crippling future generations — but, sadly, the Kiyosakis had a feeling this might be the case. And that’s why they created the Rich Dad solution many years ago.

Gamification in education

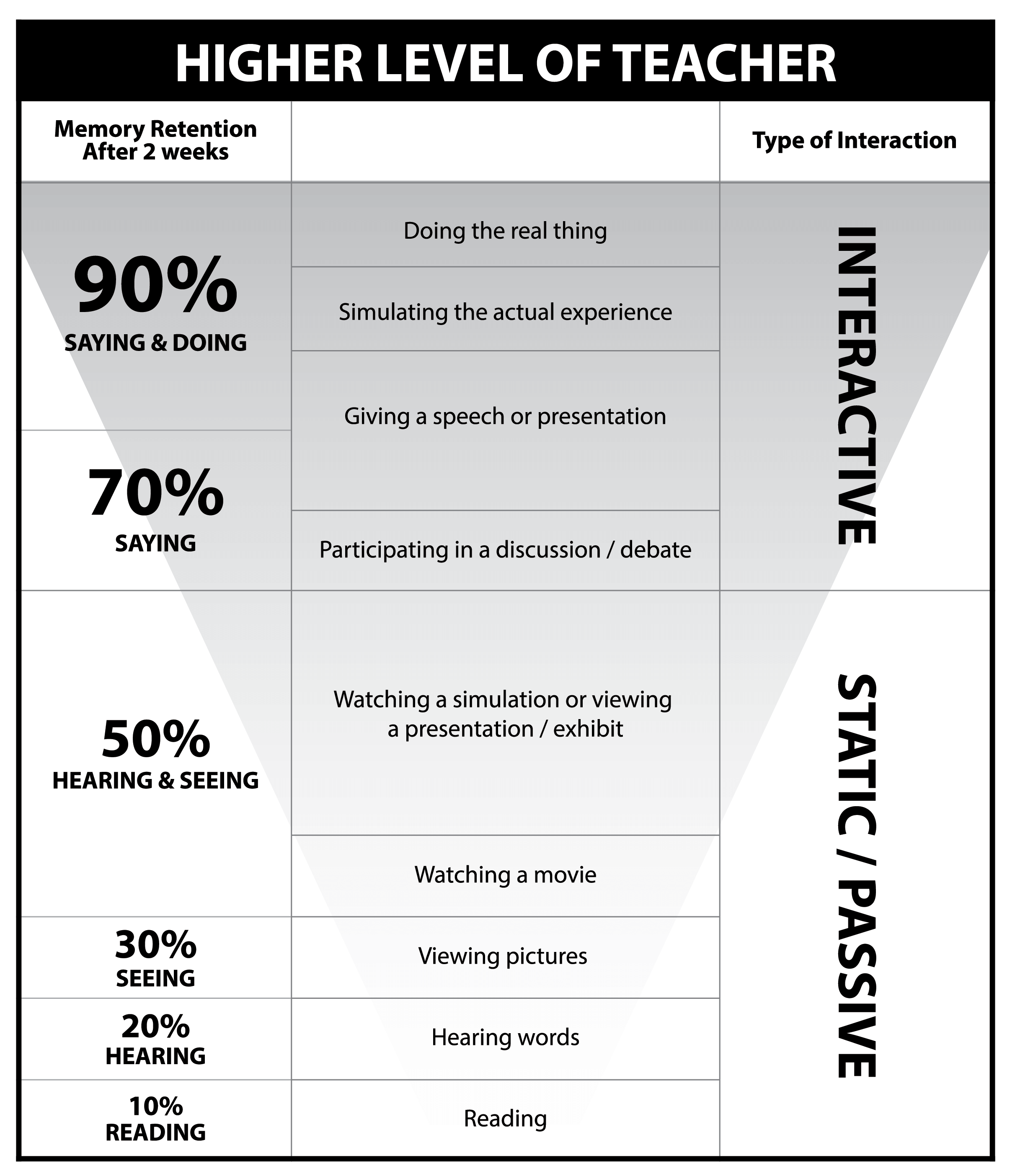

At Rich Dad, there is a conscious choice to incorporate games into the education methods because they require more action than a lecture. In fact, working with students around the world, the Kiyosakis discovered there is a full spectrum of ways people learn. To help them explain the different ways that people learn, they developed the Higher Level of Teacher diagram.

Traditionally, schools use reading and listening to reinforce the learning process. But as the Higher Level of Teacher illustrates, people only retain about 10-20% of what they read during study time or listened to during class two weeks previously.

But if reading and listening to teachers doesn't work, what does?

Doing the real thing.

Looking back, the Kiyosakis were clearly ahead of their time.

In 1996, Robert and Kim created their educational board game, CASHFLOW® the Board Game, and sent it to a group of instructors at a prominent university for their feedback. Their response? “We do not play games in school and we are not interested in teaching young people about money. They have more important subjects to learn.”

The mindset was astonishing.

First, how is learning about money not important? Second, despite the rising pile of evidence that proves humans learn best by doing—such as playing games—they still want students to learn by listening and reading? Gamification in education is a proven approach, so we couldn’t believe how quickly they dismissed our idea.

In 2012, “Gamification by Design” co-author Gabe Zichermann gave a TED Talk called Changing the Game in Education. In it, he said: “Humans are “doing” machines. We do. That’s our nature… and it turns out there’s a core biological reason why we do, and it’s an amazing little neurotransmitter called dopamine.”

Zichermann goes on to explain how the modern education system is fundamentally opposed to our nature as humans. He purports that asking us to sit down and pay attention does very little for our education because we learn more by trying, making mistakes, and achieving success. In fact, the pleasure that we feel when we achieve something is actually the release of dopamine, and it helps us remember and learn far more effectively.

That’s why he makes the case for gamification—the process of integrating the mechanics of a game into a learning activity to increase motivation and engagement—being the future of education. Savvy schools are hopping on this bandwagon, as are corporations, who are also finding it to be an effective tool for employee training.

Zichermann says gamification is 75 percent psychology and 25 percent technology, and that a gamification tool taps into the psychological behaviors that govern the day-to-day decisions we make—providing a platform for competition, sharing your achievements, and managing the progress of your work.

Hmmm, it sounds to me like gamification in education is exactly what this country needs to learn more about their personal finances and investment strategies.

It’s time for your family game night

Of course, Robert and Kim didn’t take no for an answer just because one university rejected the board game. They kept circulating it and can now proudly say that many schools have seen for themselves how effective CASHFLOW the Board Game is in their classrooms.

They knew they had finally come full circle when Arizona State University’s Thunderbird School of Global Management utilized Rich Dad Poor Dad, CASHFLOW Quadrant, and the CASHFLOW games in its curriculum. This prestigious university is internationally recognized for its programs, so it was an important (and impressive) validation for their work.

They also know that there’s a larger market for their products. CASHFLOW has become a popular household tool for parents to help educate their children since schools are obviously failing. Even community organizations, such as churches and youth programs, are using it to teach financial education to their members.

When was the last time you enjoyed a family game night?

Investing in your own copy of the CASHFLOW board game can change your child’s future (and probably improve your own).

How?

Gamification = Education + Fun

Educational games create more understanding. Instead of seeing fear and doubt, the players begin to see opportunities they never saw before because their understanding increases each time they play the game. Plus, it’s a low-risk environment in which you can practice financial and investing tactics that you’d be otherwise scared to do in real life. Each game teaches new skills, opens up your mind to a world of opportunity, and drills home the lessons of cash flow. With repetition, those lessons will become ingrained in your psyche and how you approach your financial future. Watch in amazement as everyone’s confidence soars the more you host family game night — and eventually, it will translate into actual investing activities.

And this isn’t just hypothetical information — there are countless stories of people who have played CASHFLOW (and other Rich Dad games) and have had their lives suddenly changed. They have gained a new understanding about money and investing, an understanding that pushed out some old thoughts and gave them new possibilities for their lives.

Because at Rich Dad, we are committed to harnessing the power of games to change people’s financial lives, we also spent a lot of time and resources creating a digital version (CASHFLOW Classic) that anyone can play for free. And we’ve created a host of educational apps and games that help you and your loved ones understand how money works and how it can work for you.

So, if you’re ready to grow you and your family’s financial IQ, the answer is clear: Harness the power of play.

Grab some additional CASHFLOW game resources here.

Original publish date:

December 07, 2017