You may have noticed some unrest over the last couple of months. Most CEOs are tightening their belts, while employees are fearful they may be laid off. The US GDP growth is estimated to slow to under 1% in Q2 and Q3 of 2024, and while it’s not confirmed there will be a recession, people are preparing for one.

Understandably, many people are concerned—especially the poor and the middle class. The rich, not so much. As you can find in this post, the rich aren’t too concerned with whether the economy is up or down. They know how to make money in either scenario.

This is because of one key point in that post, “This is because the rich understand one important thing about money that many others don’t: it is a currency.”

The rich are getting richer

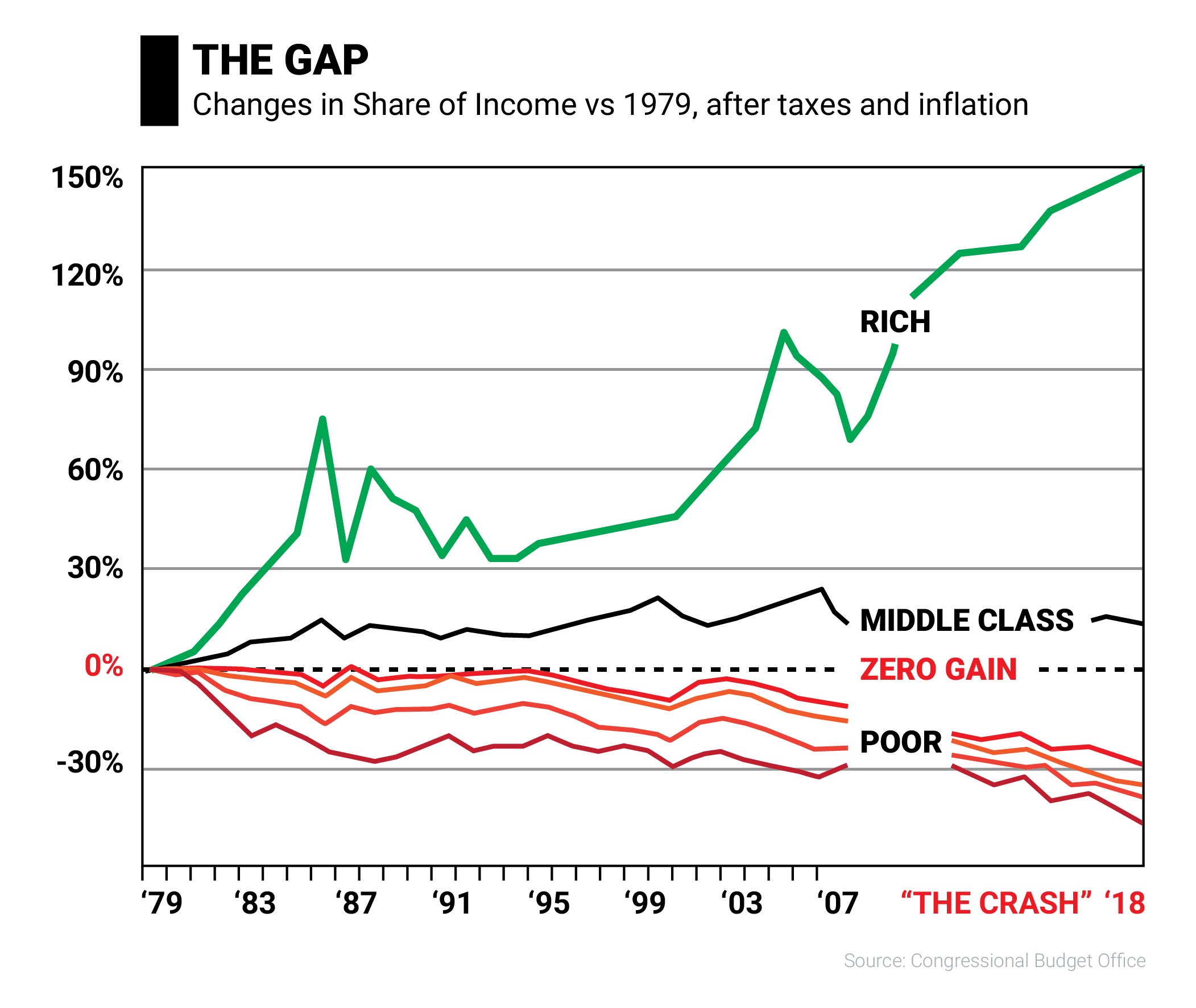

In the book, “FAKE: Fake Money, Fake Teachers, Fake Assets,” Robert Kiyosaki shared this chart:

What this chart shows is that the rich know something about money that the middle class and the poor don’t. During booms and busts, the poor are continuing to get poorer, it doesn’t matter which economy it is. The middle class are treading water. The rich are getting richer. But how?

A history lesson on money

In his book, “Increase Your Financial IQ,” Robert also wrote about the four economic ages of humanity.

They are:

- The Hunter-Gatherer Age:

In the Hunter-Gatherer Age, humans relied on nature to provide wealth. They were nomadic and went where the hunting was good and the vegetation plentiful. You had to know how to hunt and to gather—or you died. For the hunter-gatherer, the tribe was social security. Socio-economically, everyone was even. They were all poor.

- The Agrarian Age:

The Agrarian Age saw the rise of classes between people. Due to the development of technology to plant and cultivate the land, those who owned the land became royalty, and those who worked it became peasants. The royals rode horses while the peasants walked. Socioeconomically there were two groups, the rich and the poor.

- The Industrial Age:

While many people would place the beginning of the Industrial Age in the 1800s with the rise of factories, others would argue it actually began in 1492 with Columbus. When Columbus struck out to find the New World, it was to find new sources of valuable resources such as oil, copper, tin, and rubber. During this time the value of real estate shifted from growing crops to providing resources. This led to the land becoming even more valuable. And three classes emerged: the rich, the middle-class, and the poor.

- The Information Age:

Today, we are in the Information Age, where information leveraged by technology and inexpensive resources like silicon produce wealth. This means that the price of getting wealthy has gone down. For the first time in history, wealth is available to just about everyone. There are now four groups of people: the poor, the middle-class, the rich, and the super rich.

As Bloomberg reported, “After years of declines, America’s middle class now holds a smaller share of U.S. wealth than the top 1%.”

The reality is that money is no longer money. It is a full currency, and the true value in a currency world is being able to control and manipulate information. That is what the rich and the super rich have become experts at.

Losing money in the blink of an eye

The problem with the Information Age is that you can lose a lot of money very quickly if you blink.

The pace at which information flows and changes, and the massive amounts of information that come our way can make it very hard to respond correctly and in time. This reality makes it hard to think proactively because if you’re not careful, and you don’t have a financial education, you’ll react to every piece of information that comes your way.

The answer to being rich is not to have more money

Have you ever heard anyone say they wish they had a million dollars? Then they’d be rich, right? How about someone wishing they’d win the lottery? Then they’d be set?

Of course the world is full of people who have made a million dollars or won the lottery and lost it all. They are not rich any longer. Why is that?

Fundamentally, it’s because they misunderstand what makes you rich in the first place—and what money really is.

The mindset of the poor

Today, traditional assets do not make you rich or financially secure. Just ask all those “investors” who lost everything during the last Great Recession when their homes and 401(k)s were decimated. Today, you can lose money on business, real estate, stocks, bonds, and commodities. Any asset class can fail at any given moment. Just look at what happened in the age of COVID.

This wasn’t always the case. The Boomer Generation, for instance, could count on the old rules of money to work. For the most part, the dollar was steady so saving made sense, houses rose modestly each year in value, and employers took care of you in retirement. Money, for all intents and purposes, was money, and you could count on it.

That is not the case any longer. If you trust in those things, you’re in a world of financial hurt. Trusting in the old rules of money is the mindset of the poor.

The mindset of the rich

The rich have a different mindset when it comes to money. They understand that there are new rules to money and that the old rules no longer work.

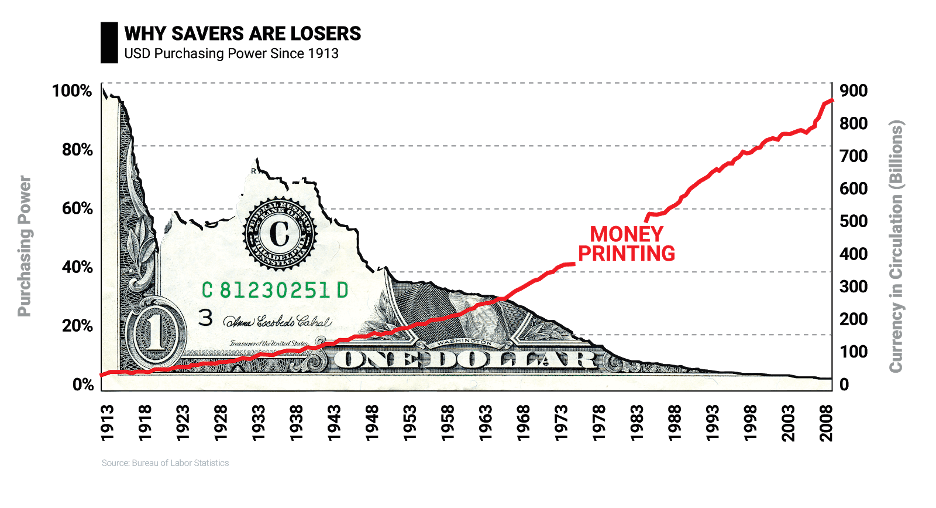

So, where the poor think that you need money to be rich, the rich know that savers are losers and that the magnitude of your wealth is relative to the velocity of your money.

Where the poor think their house is an asset, the rich know that your house is not an asset.

Where the poor think that you need a good academic education in order to be rich, the rich know that financial education is actually much more important.

Two Types of Financial Education Information

In the Information Age, traders are in the worst position. It’s nearly impossible for a trader to keep up with the flow of information. And since they make their money through transactions, buying and selling, they are susceptible to market swings they have no control over. They are addicted to immediate information.

If you want to get rich quickly, you can take your chances with immediate information. Of course, that means you can also get poor fast. If you want to build a lifetime’s worth of wealth, stick with historical information.

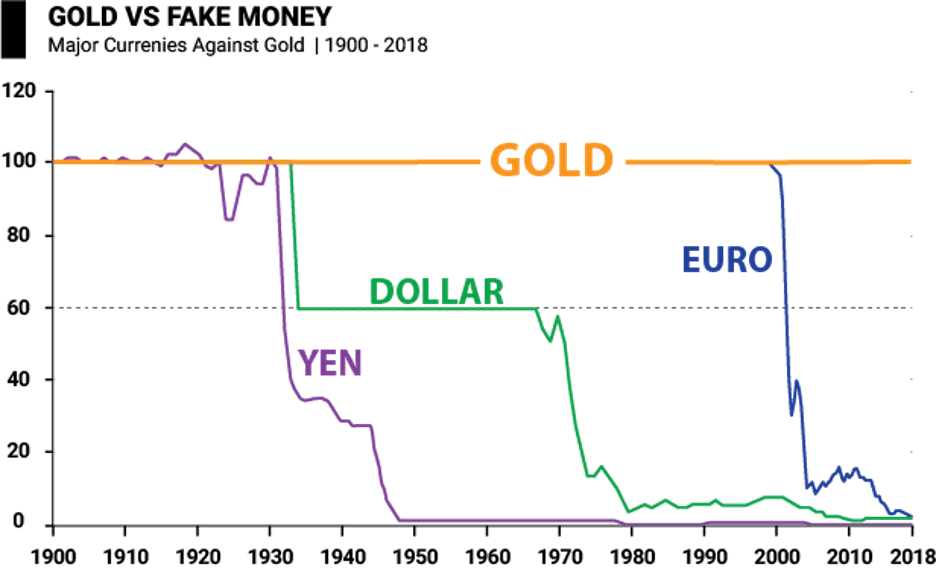

For instance, historical information says that every currency in the history of the world goes to zero. So the rich invest in gold, silver, and oil, as well as real estate. These assets go up in value as the value of a currency goes down. They’re long-term investments, and assets like oil wells and real estate also cash flow, putting money in their pockets each month.

Sure, they still pay attention to some of the immediate information, like watching the price of gold closely, but not because they want to sell gold and make a quick cash profit. Instead, they want to know when gold goes down low enough to buy some more. The rich trust gold more than the dollar in the long run. Take a look at some more charts from Robert Kiyosaki’s book, “FAKE: Fake Money, Fake Teachers, Fake Assets.”

As you can see, over the last nearly 120 years, the price of gold has held its value relative to the world’s “money.” That’s because gold is real money. It’s God’s money. That is historical information you can rely on.

Another piece of information that is historical and easy to understand is that the more “money”, i.e., currency, the government produces and puts into the system, the lower its value becomes. This is why the rich don’t trust in the government’s money; rather, they trust timeless money like gold, silver, real estate, and oil.

The good news is that, like the rich, you can learn to print your own money by understanding the history of money and how to use that information to your advantage.

For the trader, immediate information rules. It’s about buying and selling at the bottom and the top. The problem is you never know exactly when that is, so you have to make your best guess. Sometimes, you make a great guess. Other times, you make a tragic one. It all depends on the quality of your information.

How the mind works

Financial advisor John MacGregor recently wrote a book called “The Top 10 Reasons the Rich Go Broke: Powerful Stories that will Transform Your Financial Life…Forever“.

In that book, he shares a helpful framework for how the mind works. It has the memorable acronym, B.E.A.R.

B – Beliefs, the fundamental thoughts that form the basis of all we do. These are almost completely subconscious. As Johns writes, “Our beliefs are our framework for how we think and act. But our beliefs aren’t reality; they’re our opinions of what we believe to be true. These opinions closely determine our actions.”

E – Excuses, the things we verbalize that stem from our beliefs, such as, “I don’t have enough time.” John writes, “Excuses create a cycle that return you back to your beliefs, no matter how flawed or inaccurate they are, and you rely on your built-in excuses (based on your beliefs) to keep you rooted in the same bad habits.”

A – Actions, the decisions we make based on our beliefs and excuses. With enough time, excuses lead to bad decisions, and these bad decisions are your actions (and yes, inaction is the same as action).

R – Results, the natural outcome of your beliefs, excuses, and actions. The just desserts.

As John puts it, if you want to change your results, you have to change your beliefs, which changes our excuses, and leads to higher quality actions.

This is a mindshift; and if you want to be rich, you have to have a money mindshift, one that gives you the mindset of the rich.

Behind every great movement in history, and every great achievement on an individual level, is a great mindshift, a complete change in mindset, that changes the course of history—public or personal—forever.

The four mindshifts of humanity

Earlier, you read about the four economic ages of humanity. When you think about economic ages, they are really global mindshifts, spurred by changes in technology and human thought, and what is possible because of that technology.

Today, since we live in the Information Age, there is more information than we know what to do with at our fingertips. Information is the new money, but just like the poor and the middle class, having lots of “money” doesn’t make you rich. It’s knowing what to do with that money. That is knowledge.

But even though we live in the Information Age, it is not information that makes you rich. You must make the mindshift from information to knowledge.

The difference between information and knowledge

In classrooms all across the world, the Internet is readily available and technology is second nature to most kids. Regardless of socio-economic class, information is largely free and abundant. For the first time in history, people can access information and learn about anything whether they are rich or poor.

While all this information is valuable, it’s not as valuable as knowledge. Knowledge gives you the ability to filter out unimportant information to find the important information. Knowledge gives you the power to act on information. Knowledge is what makes you rich—not information.

The knowledge mindshift

Rich dad once said, “Oil is valuable. Many people would love to own lots of oil. But owning lots of oil won’t make you rich. It’s making the mindshift to understanding how oil can make you rich that brings wealth. For instance, crude oil is of little value until it is refined. That is a complicated process that requires science and equipment. It takes knowledge to refine oil and make fuel. Fuel is valuable and will make you rich. But you can’t have fuel without oil.”

It’s no different in the Information Age. You could have all the information in the world, but without a mindshift to knowledge, you would still be poor. The reason Mark Zuckerberg, for instance, is such a success is because he has knowledge of what to do with information and knowledge of how to build technologies to leverage information.

Mark Zuckerberg’s knowledge of Internet technology enabled him to build Facebook. He also knows how to build a team and find people smarter than him to make Facebook bigger and better. Finally, he has knowledge that information is valuable for selling. Facebook excels at collecting your information, processing it, and selling it to advertisers who target their ads to make money off of you.

Will you make the money mindshift?

It is not the information that makes Mark Zuckerberg rich, it’s his ability to process and leverage it—again, that is knowledge, and knowledge comes from education.

We live in an age where wealth is abundant and accessible by everyone—including you. But you have to be financially educated to be able to process and leverage it.

Today, knowledge makes you rich and a lack of knowledge makes you poor. In this brave new world, it’s your knowledge that is the new money.

Increase your financial IQ by increasing your financial education. Then you will be able to find the important information and have the knowledge to act on it.

Invest for Cash Flow

As a final bit of advice, invest in assets that cash flow and hedge against inflation. In order to do that, you need deep and comprehensive historical information about money and asset classes. This is why it’s always best to invest first in your financial education.

Immediate information will come and go in the blink of an eye. But a comprehensive financial education will last you a lifetime and help you build wealth for generations.

For more information, check out the financial education resources here.