Blog | Personal Finance

The Key to Becoming Rich: Always Pay Yourself First

The true definition of pay yourself first and why the rich don’t save

Rich Dad Personal Finance Team

March 06, 2025

Summary

-

If you want to be rich, stop saving your money

-

Don't let your debt get in the way of becoming rich

-

The 10/10/10 method - you're surefire way to becoming rich

When you receive a paycheck, who do you pay first? If you’re like most Americans, you’re probably paying everyone else first—your rent/mortgage, groceries, utilities, car payment, insurance, etc. Then, once you’re done paying all those bills, you stick whatever you have left (if anything) into savings—that’s the classic “paying yourself last” scenario. Then you patiently await your next paycheck and repeat the process all over again. That’s the great American Rat Race.

But if you ever want to get out of the Rat Race, you’re doing it all wrong.

The rich don’t save, they do this instead

The philosophy of paying yourself first came from George Clason’s book, “The Richest Man in Babylon,” which was written nearly a century ago. And, despite how the world has changed, its message still holds true today.

When Robert and Kim Kiyosaki were just beginning their financial journey, they found themselves living paycheck to paycheck. Eventually, they hired a bookkeeper, Betty, with the hopes of living with an honest and transparent view of their financial situation - it was time to be accountable!

Immediately, Betty helped them realize they were not setting anything aside for their future. Each and every penny was going directly towards their bills.

This is the quickest way not to get rich.

How to pay yourself first

Robert and Kim began changing their habits, and decided to pay themselves first, then pay their creditors.

Each month, whether it made sense or not, they put aside a set sum of money into their asset column. Treating it just like an expense, they made sure to prioritize this column, even if their cash flow was less than their bills.

The power of the pay yourself first principle

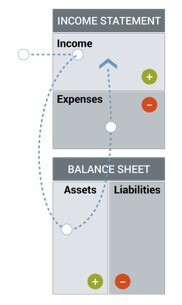

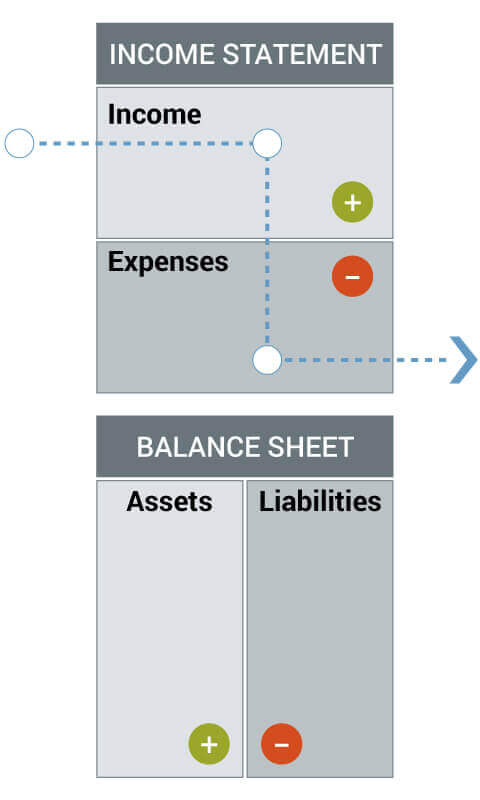

Below are illustrations for two short stories:

Here is the first story:

Here is the second story:

Simply put, a picture is worth a thousand words.

Study the diagrams above and see if you can pick up some of the distinctions between the two stories. If you’re financially intelligent, you can see important distinctions and the story that they share.

The first diagram depicts the actions of those who put the pay yourself first principle into action. Each month they allocate money to their asset column before they pay their monthly expenses.

The second diagram depicts the actions of those who pay everyone else before they pay themselves. Each month they allocate money to their expenses column and then save or invest with whatever is left over—which is usually nothing. This is the diagram of those in the rat race, no matter how much money they make, they are poor.

If you understand the power of cash flow, you will understand what is wrong with the second diagram. It’s the reason why 90 percent of people work hard all their lives and need government support like Social Security when they are no longer able to work. The reason is they pay themselves last.

In order to be rich, you must have the self-discipline to pay yourself first. By this, we simply mean using your income to invest in cash-flowing assets before you pay your bills or buy anything fun. This in turn will create more income that you can use to invest in more, cash-flowing assets. Do that and you’ll have more money than you know what to do with.

Paying yourself first is not easy. In fact, it can be scary, especially when the bills are piling up. But you must develop the self-discipline to do it.

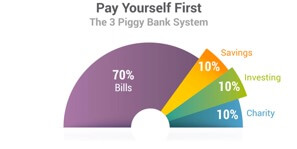

Introducing the 10/10/10 Plan

Robert and Kim eventually came up with the 10/10/10 plan. Every month, they took 30% of their paychecks, and divvied it up like so:

10% Investment - Each month they set aside 10 percent of their income for great investment opportunities. They typically chose to invest in real estate.

10% Savings - Each month they then set aside 10 percent of their income for emergencies and special opportunities. This was not a savings account that was intended for survival.

10% Charity or Tithing- And each month, they set aside 10 percent of their income for giving to charity or tithing because they truly believe in giving back and that you must give in order to receive.

Adjusting habits

First, don’t get into large debt positions that you have to pay for. Keep your expenses low. Build up assets first. Then buy the big house or nice car later.

Second, when you come up short, go ahead and let the pressure build — don’t dip into your savings or investments as a bailout. You see, poor people have poor habits. And one of those poor habits is dipping into savings to pay bills. Use the pressure to inspire your financial genius to come up with new ways of making more money, and then pay your bills with that. Bonus: You will have increased your ability to make more money and boosted your financial intelligence.

So let’s say you’re taking home about $4,000 a month. If you first pay yourself $500, then you have $3,500 left for living expenses. After one year’s time, you’ll have paid yourself $6,000. You can even set this up automatically with your bank, to remove the temptation of spending the money.

If you want to be rich, don’t save your money

The traditional financial advice to save your money is a popular one. But for most people, saving is not a way to get rich or stay rich.

In fact, for the vast majority of people, saving is a sure fire way to lose. Why? Because inflation often rises higher than the interest rates you’re paid for your money. So the whole time it’s sitting in your bank account, your savings is actually losing money.

To illustrate this let’s use a nice round number like $100. If you have that amount in savings with a 1.5%, an average interest rate banks give these days, you’ll have $101.50 by the end of the year.

According to Bankrate: “...prices are 23% more expensive today than they were before the coronavirus pandemic recession began in February 2020.”

Unfortunately for you, this isn’t taken into account when the banks are making their interest offers on your savings. Multiply that difference over time, and you could be in for a big loss on the purchasing power of your money.

What’s worse, money is a currency. If it doesn’t keep moving, it dies. One sad thing about savers is that they never put their money to work for them, and because of this, they don’t become rich.

This is why rather than teach people to be savers, we teach them to be spenders—in the right way.

Too much debt to become rich?

Not to fear. Despite having about $400,000 of debt in 1984, Robert and Kim wound up debt free by 1990. Here are some tips:

Step 1:

Immediately stop accruing bad debt. Stop adding to your credit card balances.

Step 2:

Make a list of all the debt you owe (credit card, school loans, car loans, IOUs to people, your personal residence, etc.) so that everything is clearly organized and accounted for.

Step 3:

Hire yourself a “Betty” (a bookkeeper), so you can’t hide from the truth—he or she will keep meticulous records each month, so you always know where you stand (even if you don’t want to admit it).

Step 4:

The 10/10/10 plan. After working with Betty, Robert and Kim decided that with every dollar that came into their household, they’d take a set percentage off the top and set it aside. This was the beginning of them paying themselves first. They set up three piggy banks: one for savings, one for tithing or charity, and one for investing. Each receiving a set percentage of 10%, for a total of 30% of all income they earned. Keep in mind, you don’t have to start off with 30%, but whatever percentage you choose, stick with it each month and increase when possible.

Step 5:

Determine the order for paying off each debt by starting with the lowest and working toward paying that off. For all other debt, just pay the minimum amounts due each month. Once your first (lowest) debt is paid off, then work on the next debt (second lowest) and so on.

Step 6:

Stay the course! Remember, you have to stick to this plan every month. If you say to yourself, “I’ll go off the plan just this month,” then you won’t form the habit and your debts will not go away.

Clarity is key

Some people get the wrong idea when they hear the term, “Pay yourself first.” They actually hear, “Treat yourself first.” They think it means splurging on things frivolously.

Instead, the purpose is to make a conscious and purposeful contribution to the asset column so that one could invest their money and make it work for them.

This is where the golden financial rule comes in: any money in the asset column stays in the asset column.

For instance, Kim started investing by purchasing a small home in Portland, Oregon many years ago. By keeping the money earned from that investment in her asset column, she’s been able to build from that foundation to now owning thousands of apartment units across the United States. All it took was discipline (and hard work!).

The rich don’t cut expenses...they increase them

This doesn’t mean Robert and Kim don’t enjoy the finer things in life. Cutting expenses is what the poor do. The rich do not cut expenses. Rather, they ask, “How can I afford that?”

If you want something nice for yourself, you need to find ways to make the money that doesn’t mean raiding your asset column. In short, find assets that produce enough income through cash flow to cover your expenses and luxuries.

Robert, for instance, loves his cars. Long ago, he wanted to buy his dream Porsche. So, he got to work and found a great mini storage investment that covered the cost of the car with monthly cash flow. Thus, he got the Porsche and grew his asset column!

The point is: Never subtract from your asset column to add to your liability column. Instead, always keep it in the asset column and add to it in order to afford the things you want.

Start today

While you’re working to get your personal finances under control, it’s a good time to start planning ahead for the real estate investments that’ll help you grow richer. Start by exploring our free investing classes today.

Original publish date:

September 21, 2017