Blog | Personal Finance

The 7 Basic Rules of Investing

Adjust your investment strategy and put your extra money to work for you in income producing assets

Rich Dad Personal Finance Team

February 09, 2023

One of the key signs of approaching financial freedom is the steady movement from the left side of the CASHFLOW® Quadrant to the right side of the quadrant.

The process of moving from being an employee or self-employed to a business owner or sophisticated investor is a bit like that of a caterpillar turning into a beautiful butterfly. It takes time, and often requires a total transformation in mindset and behavior.

One of these behavior changes is understanding what to do when you have more money suddenly at your disposal. Whether it’s from an inheritance, a raise or bonus, or some other source, the temptation for those on the left side of the quadrant can be to, at best, follow conventional advice about money, or, at worse, to spend it on liabilities like cars or vacations.

Such conventional advice could be to increase your contributions to your 401(k) or to save as much as possible and continue to live below your means. We’ve talked a lot about all of these topics, and it should come as no surprise that none of them are considered “sound advice.”

If you’re facing a windfall in new money, now is the perfect time to put into place the rich dad fundamental: invest in cash-flowing assets.

But in order to do that, you need to understand the investing fundamentals. Here are seven basic rules of investing to master, as taught by rich dad.

Basic rule of investing #1: Adjust your money mindset

In the book “Rich Dad’s Guide to Investing: What the Rich Invest in, That the Poor and the Middle Class Do Not!” it talks a lot about adjusting your mindset from that of the poor and the middle class to that of the rich.

The poor and the middle class teach their kids the following: “Go to school, get a good job, work hard, and save money. That will make you rich.”

The rich teach their kids the following: “Learn how money works, create good jobs, have money work hard for you, and invest in cash-flowing assets. That will make you rich.”

One of the fundamental errors of the poor and middle class mindset is that they think you can get rich by working for a salary. But in reality, that’s very hard to do because of the way the tax code is structured. Because the government takes taxes out of a paycheck before an employee even sees it, they are always at a disadvantage when it comes to business and investing than that of a business owner. Why?

Business owners can invest their money pre-tax. Not only does this give them more money to work with, but it also reduces their total taxable income, which means they often pay less in taxes than the poor and the middle class. This is a rich mindset. It also explains why so many of the poor and middle class were in an uproar when they learned during the presidential election that Donald Trump paid $0 in taxes. They simply don’t understand how money works and how the rich operate.

If you want to be rich, you need to first adjust your mindset about money and investing. That starts with the realization that there is more than one type of income you can earn.

Basic rule of investing #2: Know what kind of income you’re working for

Most people think only of making money at a good job. They don’t realize that there are different kinds of income. Rich dad, however, always drilled that there are three kinds of income, and they are all informed by the different types of mindset.

Ordinary earned income

Ordinary earned income is the type of income that most people think of when they talk about making money. This is the income of the working 9 to 5 set. It is generally earned from a job via a paycheck. It’s the highest-taxed income, and thus, the hardest to build wealth with due to the government taking money out of your paycheck before you even get it and the fact that you’re trading time for money. Your ability to earn is based on how long you can work. Earned income is the income you have the least control over. It is determined by your employer, and it can be cut or you can be fired. And if you want to make more money, you have to either find a job or hope that your employer will decide to pay you more.

Portfolio income

Most high-paid employees also have some form of portfolio income, usually in the form of a 401(k) and various paper assets like mutual funds managed by a financial advisor. Portfolio income is generally derived from paper assets such as stocks, bonds, and mutual funds. It is the second-highest taxed income, and is moderately hard to build wealth with due to low returns. Most experts say you can expect about 7% a year in returns for your portfolio income over a long period of investing. There are of course big ups and downs that can happen during that time. A return of 7% might seem like a lot to a person with low financial intelligence, but the rich would balk at an investment strategy that only promised that much in return. Much like earned income, you have little control over your portfolio income. You are at the mercy of the ups and downs of the stock market and the skill of your advisor.

Passive income

People with a high financial IQ have an investment strategy that aims to create passive income. Passive income is generally derived from real estate, royalties, and business distributions. If you receive rent from a property, that is passive income. Robert Kiyosaki gets royalties from his books, making them cash-flowing assets that provide passive income. If you own a business that distributes profit to you, that is also passive income. In short, it is income that comes to you whether you are working or not. It is the lowest-taxed income, with many tax benefits, and is the easiest income to build wealth with thanks to its combination of low taxes and potentially infinite returns.

Rich dad said, “If you want to be rich, work for passive income.”

Basic rule of investing #3: Convert ordinary income into passive income

Most people start their life out by making ordinary earned income as an employee. The path to building wealth then starts with understanding that there are other types of income and then converting your earned income into the other types of income as efficiently as possible.

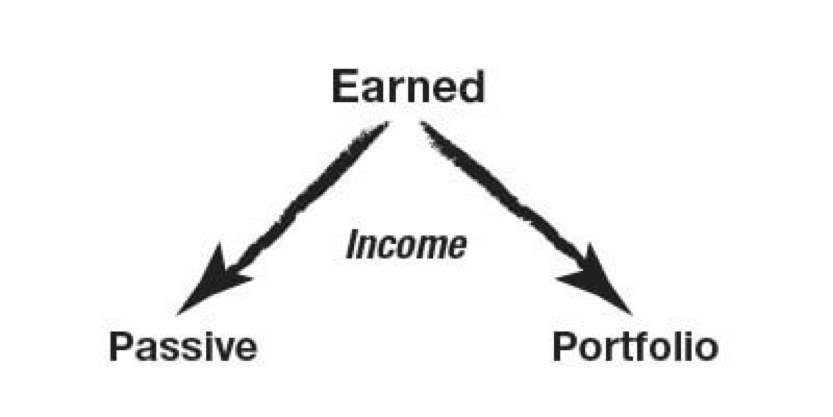

To illustrate this, rich dad drew a simple diagram:

“That, in a nutshell,” said rich dad, “is all an investor is supposed to do. It’s as basic as it can get.”

This is why when someone gets a raise, they shouldn’t put it in a 401(k) or to live below their means, which essentially means saving. Rather, they should pay themselves first and invest that money in cash-flowing assets. In short, convert your pay raise into passive income.

The easiest way to do this is to make your investment costs an expense and to make it your most important expense.

Basic rule of investing #4: Savers are losers

That takes us into basic rule #4.

Despite the conventional advice, saving your money is not the key to financial independence and financial freedom.

The fact is, savers are losers. You know, the ones who put their money in a low-interest account with hopes that by the time they get to retirement, it will have magically grown into all they need to live.

That doesn’t work, and it's bad financial advice. In an economy where almost everything is built to take your money, saving it is of little value. From inflation to taxes to hidden fees in your 401(k), the system is stacked against you.

Instead, spenders are today’s winners.

Money is not backed by anything. It is a currency, which, like a current of electricity, is always moving. Today, money flows from one sector to another. If it stops moving, like a current it dies. If your money isn’t moving, it is dying, slowly, losing value day by day.

The rich know they must keep track of where money in the markets is moving, and they must move their money accordingly. This is why the traders who made the Big Short profited so spectacularly. They were paying attention and saw where money was moving. But more than that, they saw the assets it was moving into and understood the value of those assets was garbage. They knew that they could get ahead of the curve and move their money to where others eventually would. And in the world of money, the first always feast and the last always starve.

Basic rule of investing #5: The investor is the asset or liability

Many people think investing is risky. The reality, however, is that it’s the investor who is risky. The investor is the asset or liability.

“I have seen investors lose money when everyone else is making it,” said rich dad. “In fact, a good investor loves to follow behind a risky investor because that is where the real investment bargains can be found!”

What this means is that your financial knowledge can either be an asset or a liability. If you have a low financial IQ but decide to dive into big-time investments anyway, you’ll make a lot of mistakes that investors with a high financial IQ will capitalize on.

If you want to move from being a risky investor to a good investor, first invest in your financial education. As part of your education—because nothing beats real-life experience—start small with your investments, learn from your mistakes, and then make bigger and bigger investments.

You can also play games that simulate investing to build your financial intelligence. We designed CASHFLOW the Board Game specifically to teach you how to think and invest like a rich person.

Basic rule of investing #6: Good deals attract money

In the beginning, you may be concerned about how to raise money if you found a good deal. Remember, your job is to stay focused on the opportunities in front of you, and to be prepared.

“If you are prepared, which means you have education and experience,” said rich dad, “and you find a good deal, the money will find you or you will find the money.”

Rich dad’s point is that getting the money was the easy part. The hard part was finding a great deal that attracted the money—which is why so many people are ready to give money to a good investor. This is called OPM, a.k.a., Other People’s Money, and it’s worth learning more about.

Basic rule of investing #7: Learn to evaluate risk and reward

As you become a successful investor, you must learn to evaluate risk and reward. Rich dad used the example of a nephew building a burger stand.

“If you had a nephew with an idea for a burger stand, and he needed $25,000, would that be a good investment?”

“No,” Robert answered, “There is too much risk for too little reward.”

“Very good,” said rich dad, “but what if I told you that this nephew has been working for a major burger chain for the past 15 years, has been a vice-president of every important aspect in the business, and is ready to go out on his own and build a worldwide burger chain? And what if you could buy 5 percent of the company with a mere $25,000? Would that be of interest to you?”

“Yes,” Robert said. “Definitely, because there is more reward for the same amount of risk.”

Learning and mastering the rules of investing takes a life-long investment in financial education. But these basics will get you started. Where you go from here is up to you.

Start mastering the seven basic rules of investing with our ground-breaking investing game, CASHFLOW the Board Game.

Original publish date:

October 10, 2017