Blog | Personal Finance

How to Avoid Financial Ruin

My book “FAKE” uncovers three things to help you avoid a financial d-day.

March 29, 2022

In my book “FAKE: Fake Money, Fake Teachers, Fake Assets,” can be considered one of my most important; here’s why.

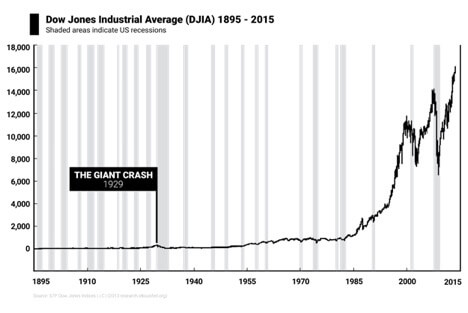

That chart represents the rise of the Dow Jones Industrial Average from 1895 - 2015, 120 years of history. The shaded areas are recessions.

You can see the giant crash of 1929, a crash that sent the country into over two decades of depression, was just a little blip. A tiny speck.

Black Monday, in 1987, which set the world to panic, was again just a small dip, comparatively. From there you can see the rapid rise of the DJIA, and the large crashes that follow.

Even when the stock market is high, the questions should always be “but how high will it go… and how far will it fall?” The truth is, that is the nature of the market - to rise and fall. Today, those falls could be bigger than ever before.

When the next crash comes it could cause financial ruin for the middle class and the poor. And it’s all because of fake money, fake teachers, and fake assets. I want to save as many of those people as possible. That’s one reason I wrote “Fake.”

Elites are making themselves richer—and you poorer—with fake money, teachers, and assets

Another reason I wrote “Fake” is because of an article I read in “Time” magazine. On May 28, 2018, I was walking past a newsstand, scanning rows and rows of magazines when the cover of “Time” called out to me with the title, “How My Generation Broke America,” by Steven Brill.

The article is about academic elites, and Brill knows a thing or two about elites. He is one himself and attended Deerfield Academy, an elite private prep school in Massachusetts, then graduated from Yale University and Yale Law School.

Quoting Steven Brill from the article:

"As my generation of [Baby Boomer] achievers graduated from elite universities and moved into the professional world, their personal successes often had serious societal consequences."

Translation: The elites got greedy taking care of themselves, at the expense of others.

"They... created an economy built on deals that moved assets around instead of building new ones."

Translation: The elites focused on making themselves rich, rather than creating new businesses, new products, more jobs, and rebuilding the U.S. economy.

"They created exotic, and risky, financial instruments, including derivatives and credit default swaps, that produced sugar highs of immediate profits but separated those taking the risks from those who would bear the consequences."

Translation: The elites created fake assets that made themselves and their friends rich and financial ruin for everyone else. When the elites failed, they were paid bonuses. Mom, Pop, and their kids would pay for the elite’s failures via higher taxes and inflation.

There’s a gross universal cash heist happening

A third reason I wrote “Fake” is because of one of the most influential teachers in my life, Dr. R. Buckminster Fuller. A real teacher.

Fuller is well known as a futurist, mathematician, and investor. He invented the geodesic dome, which was featured in the U.S. Pavilion at Expo 1967. He is also the author of the book, “Grunch of Giants.” Grunch stands for Gross Universal Cash Heist.

I had the privilege of studying several times under Fuller from 1981 to 1983. Sadly, he passed on July 1, 1983, approximately three weeks after the last time I studied with him. I remember that I immediately got a copy of his book “Grunch of Giants” and read it. Grunch is the story of how the ultra-rich are sending the world into financial ruin.

While Brill’s article focused on the academic elites who are breaking America with fake money, teachers, and assets, Fuller’s book “Grunch” focuses on those who are pulling the puppet strings of the elites. From Fuller’s lectures and books, my recollection is that the elites are puppets, and the people running Grunch are the puppeteers. As you know, puppeteers are rarely seen. They prefer to remain behind the scenes, in the dark. In “Fake”, I do my best to bring the puppeteers into the light.

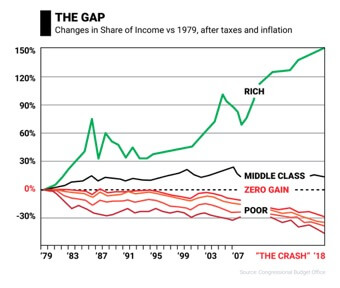

The reality is that both Grunch and the elites are making themselves richer while the poor and middle class keep getting poorer. They don’t care. They’re laughing all the way to the bank.

Financial D-Day

In 2010, I could feel the fear growing. I recall a day when the Dow was down 245 points, Nasdaq was down 68 points, and S&P 500 was down 29 points. I remember thinking: “I thought we were supposed to be in a recovery?”

The reason why that recovery was a false one—what Dan Alpert, Managing Director of Westwood Capital, called the "greatest sucker's rally in history,"—was because the underlying issues that caused the financial crisis still remained. The Fed is still printing billions and billions of dollars to pay for programs we can't afford, our debt was at record levels, true unemployment was well above 10 percent, neighborhoods across America were ghost towns littered with empty and foreclosed houses, there had been no true financial reform to address derivatives trading (what Warren Buffet calls financial weapons of mass destruction), and we were still keeping zombie financial institutions too big to fail alive with taxpayer dollars (see this Washington Post article on the so-called landmark financial reform bill).

As Katrina vanden Heuvel wrote in her column at the Washington Post:

"The current banking structure and practices virtually ensure repeated financial crises. Take that from uberbanker Jamie Dimon, CEO of JPMorgan Chase. In his testimony before the Financial Crisis commission, Dimon said: 'It's not a surprise that we know we have crises every five or ten years. My daughter called me from school one day and said, "Dad, what's a financial crisis?" And without trying to be funny, I said, "It's the type of thing that happens every five to seven years." And she said: "Why is everyone so surprised?" So we shouldn't be surprised."

The difference

Here's the difference between the ultra rich and the average American: The ultra rich know that the system is set up to experience wild swings—and they know how to profit from it. The ultra rich play by the New Rules of Money. They know that the old rules—go to school, get a good job, save your money, and invest in a diversified portfolio of stocks, bonds, and mutual funds—is financial suicide. And they're counting on you to keep playing by the old rules so they can get rich.

Welcome to a world of FAKE

We live in a world that many people now call “post-truth.” In short, we live in a world that is fake.

Former President Donald Trump popularized the term “fake news” in calling out the media—for a variety of real or perceived reporting issues. In social media, many people have fake followers. Millions of people spend billions buying fake Rolexes, fake Louis Vuitton, and fake Versace. And there are even fake pharmaceutical drugs.

Some things that are fake are harmless. If someone wants to wear a fake designer watch, all the more power to them. Other fake things have the potential to harm us and the world greatly. In today’s world, verification of what is real and what is fake can mean the difference between wealth or financial ruin, war or peace, and even life or death.

This is why I wrote “Fake,” and in the book I cover three specific and damaging fake things: fake money, fake teachers, and fake assets.

-

Fake money

Fake money has the power to make the rich richer while at the same time make the poor and middle class poorer.

In the book, I detail how the elites and Grunch create fake money, starting with Nixon taking the dollar off the gold standard, and what it means for you. Suffice it to say, the reason savers are losers in today’s world is precisely because of fake money.

-

Fake teachers

What did school teach you about money? For most people, the answer is “nothing.” Most teachers are great people. But, our educational system is broken, obsolete, and fails to prepare students for the real world.

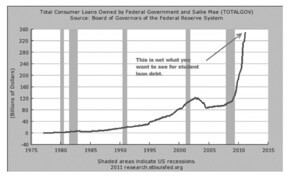

Instead of guiding students into the light, our education system is leading millions of young people into financial darkness and the worst type of debt: student loan debt.

Student loan debt is over $1.6 trillion and is the number one asset of the U.S. government. In the criminal world, this is called extortion.

Worse yet, these teachers teach knowledge that is false and damaging, such as the merits of going to a good school, getting a good job, buying a house, saving money, and investing in a balanced portfolio of stocks, bonds, and mutual funds. All fake financial truths.

After graduation, there are whole industries of gurus, advisors, and brokers who reinforce these fake financial truths while getting rich along the way.

-

Fake assets

First, we need to define and understand the difference between an asset and a liability. Assets put money in your pocket. Liabilities take money out of your pocket.

My poor dad always said, “Our house is our biggest asset.” My rich dad said, “Your house is not an asset—it’s a liability.” Millions of people believe their house is an asset.

In 2008, the housing market collapsed. Except for a few cities like San Francisco, New York, and Honolulu where housing prices have climbed higher, housing prices in many cities throughout the world are just starting to recover.

The real estate crash, however, was not a real estate crash. It was caused by fake assets—the same fake assets Brill describes in his article. It’s worth repeating exactly what he said:

"The elites created an economy built on deals that moved assets around instead of building new ones. They created exotic, and risky, financial instruments, including derivatives and credit default swaps, that produced sugar highs of immediate profits but separated those taking the risks from those who would bear the consequences."

Warren Buffett calls derivatives “financial weapons of mass destruction.” He should know. One of his companies rates and insures these derivatives.

In 2008, almost $700 trillion in derivatives exploded, nearly bringing down the world economy. Many people blamed the “subprime real estate” buyer for the real estate crash. The reality was, as Brill confirms, the elites were manufacturing fake assets called derivatives. That was the real problem.

You need financial knowledge to survive in this FAKE world

In “FAKE”, I explain why we founded The Rich Dad Company in the first place: to give people financial education so that they can thrive whether the markets are up or down.

As the old saying goes, “Knowledge is power.” In “Fake,” I hope to give you the knowledge you need to fight the powers that be, to know what is real and what is fake, and to thrive while so many others struggle to survive.

As I've often said, this coming depression will be the biggest wealth transfer in history. This is your opportunity to become rich. But you must stop playing by the old rules of money. You must understand how to make the wealth-stealing forces of taxes, inflation, debt and retirement work for you—not against you. And in order to do that, you must be financially educated.

In a time where you can panic and despair, don’t lose sight. The well-positioned will meet difficult times with recognition, and find promise and opportunity. Keep your head up. Continue to learn as much as you can. Opportunity is knocking at your door. Will you answer?

Original publish date:

April 09, 2019